This post was written for FunnelFox by Kirill Makarov – web2app funnels and paid ads expert, growth advisor, and webfunnels.club founder.

BetterMe is the #1 player in web2app, and everyone in the app space is watching them. With industry insiders estimating over $1B in revenue for 2024, their strategy has become a blueprint for others in the fitness vertical. Half the market is now copying their funnel mechanics.

To understand exactly how they drive such massive growth, I scraped and analyzed 75,000+ BetterMe ads from the past 90 days. This post is a short summary of my research and analysis. If you’d like to go deeper, you can also watch the webinar recording where I unpack it all in more detail.

Methodology of turning public data into insights

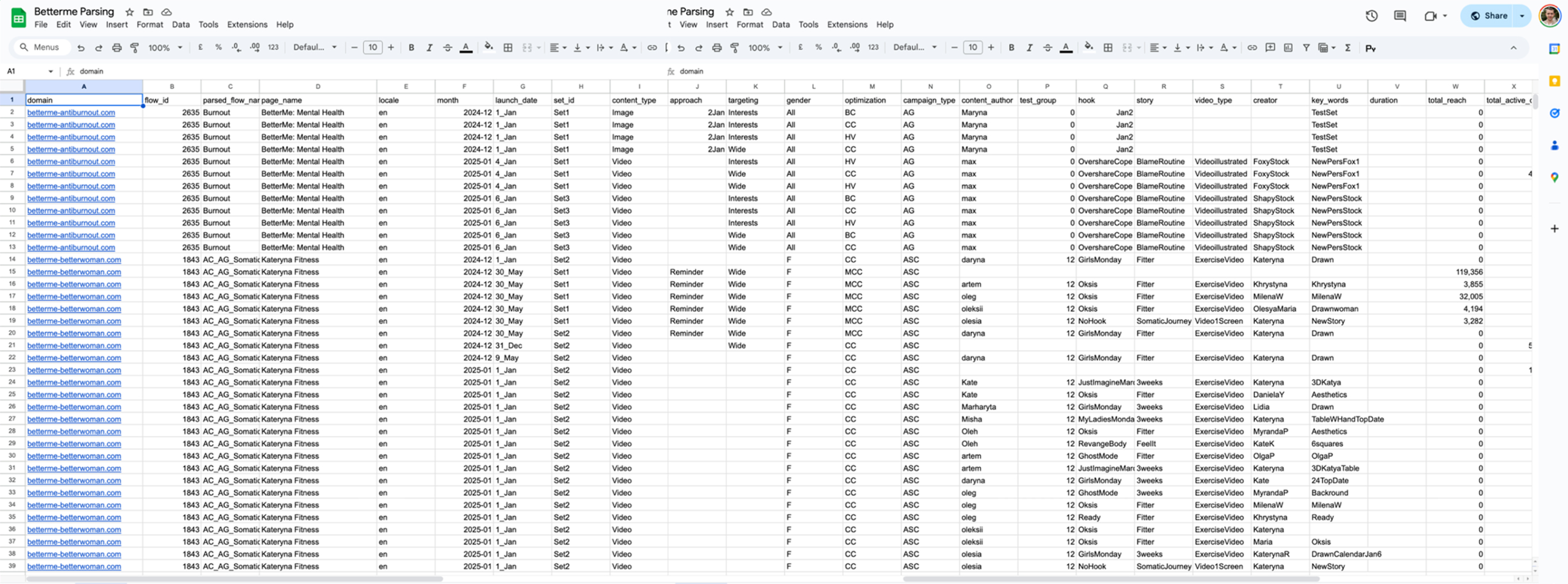

This research is built entirely on public data – no insider access needed. To break down BetterMe’s web2app strategy, I pulled 75,000+ creatives using Meta’s Ad Library and spy tools like Adheart and Tyver. These tools allow you to extract historical creatives, parse URLs, and search by naming patterns at scale.

BetterMe uses a consistent structure in its ad URLs. Inside each, you’ll find utm_campaign and utm_content parameters that encode funnel type, localization, targeting, bid strategy, and creative concept. Once you recognize the naming logic, you can filter and analyze ads by topic, audience, and strategy.

I collected creatives over the past 90 days, then used Python and SQL to structure the dataset. Each ad was mapped to attributes like funnel ID, domain, localization, creative format, and optimization type. From there, I could group flows, track growth, and reverse-engineer strategy – without needing impressions or spend data.

To estimate scale, I used creative count as a proxy for spend. It’s not exact, but it correlates strongly with actual reach in the EU, where Meta provides limited delivery data. After testing this on European campaigns, the correlation was solid enough to trust for broader volume estimates.

As for estimating revenue, no need to guess. Funnels activity and creative count, combined with typical ARPU ($1–$1.5), give a directional view. Whether BetterMe makes $300M or $900M annually doesn’t change what matters: which funnels are scaling, how they’re built, and what you can learn from them.

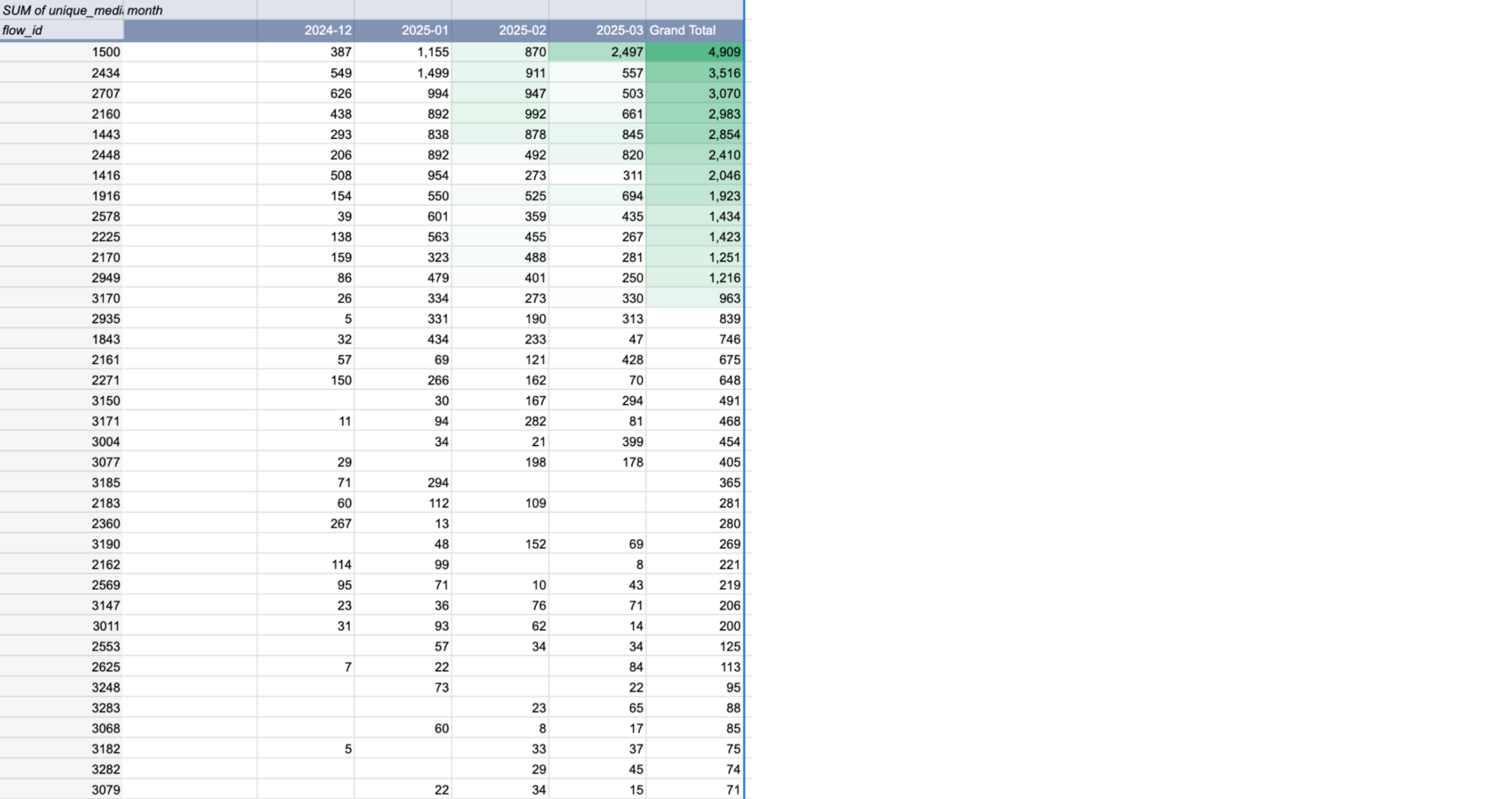

Funnels: structure, categories, and growth signals

BetterMe operates an entire matrix of web2app flows. All funnels are grouped by theme (e.g., calisthenics, fasting, yoga, mental health) and then expanded into dozens of localized, segmented, and personalized variants.

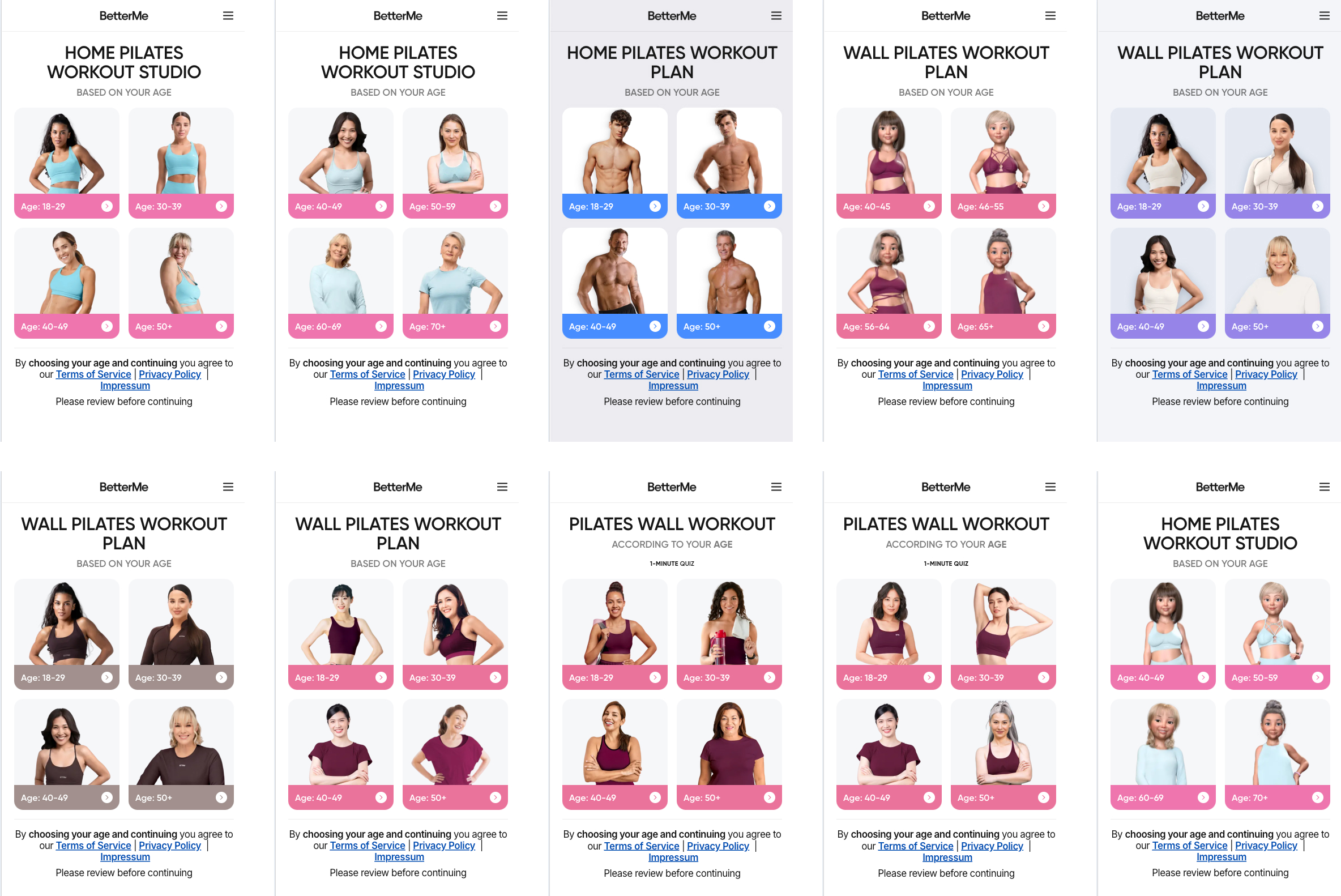

I identified 12 core funnel topics, each with multiple flows adapted by gender, age, body type, creative angle, or geo. For example, “Pilates” alone includes:

- A default flow

- Funnel for women 40+

- Funnel for males

- A variation with Asian faces for APAC

- Universal flows with mixed casting

- Color scheme tests, copy iterations, hook changes, and so on

Most of these flows are quiz-based.

What looks like “one” funnel in concept is often 10–50+ in practice. Same vertical, same end goal – but execution differs across creative tone (UGC vs. animated vs. studio), hook logic, and demographic positioning. This setup isn’t accidental – BetterMe actively tests and tweaks their funnels for different user groups to see what works best.

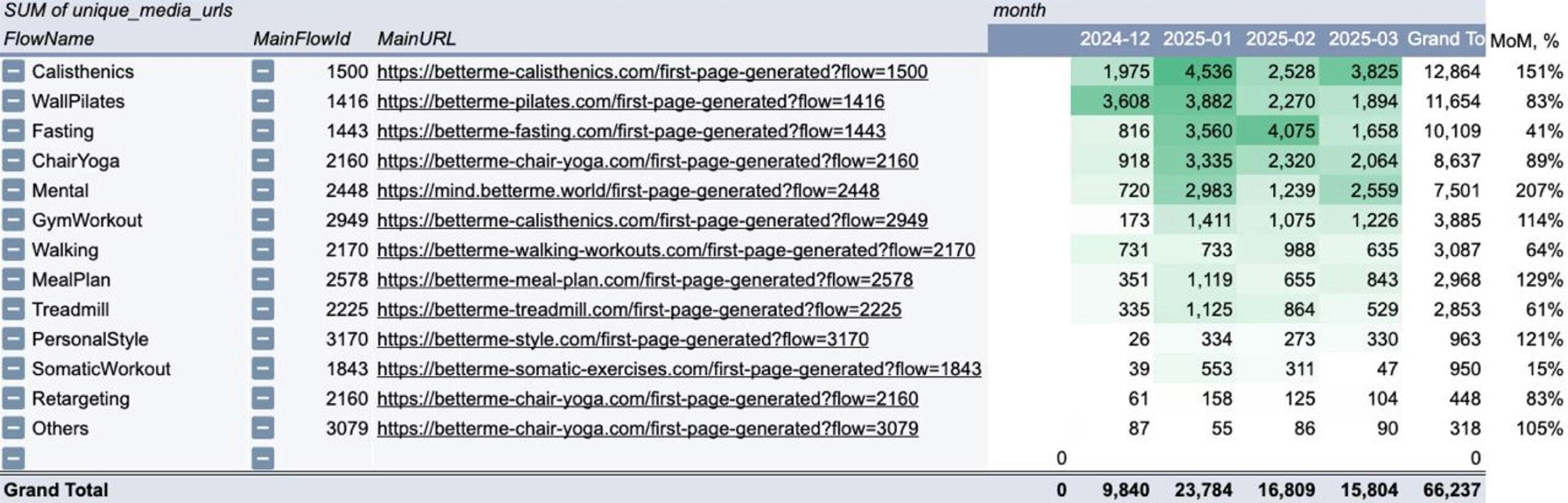

What’s growing fast

I analyzed funnel growth based on unique creatives over the past 90 days. Here’s what stood out:

- Calisthenics remains the largest category by volume

- Mental Health is growing fastest, with a 200% month-over-month increase

- Other fast movers include meal plans, somatic practices, and style quizzes

Fastest-growing funnels are:

- Mental (+207% Mar vs Feb)

- Calisthenics (+151% Mar vs Feb)

- Meal Plan (+129% Mar vs Feb)

- Somatic (+121% Mar vs Feb)

Localization strategy

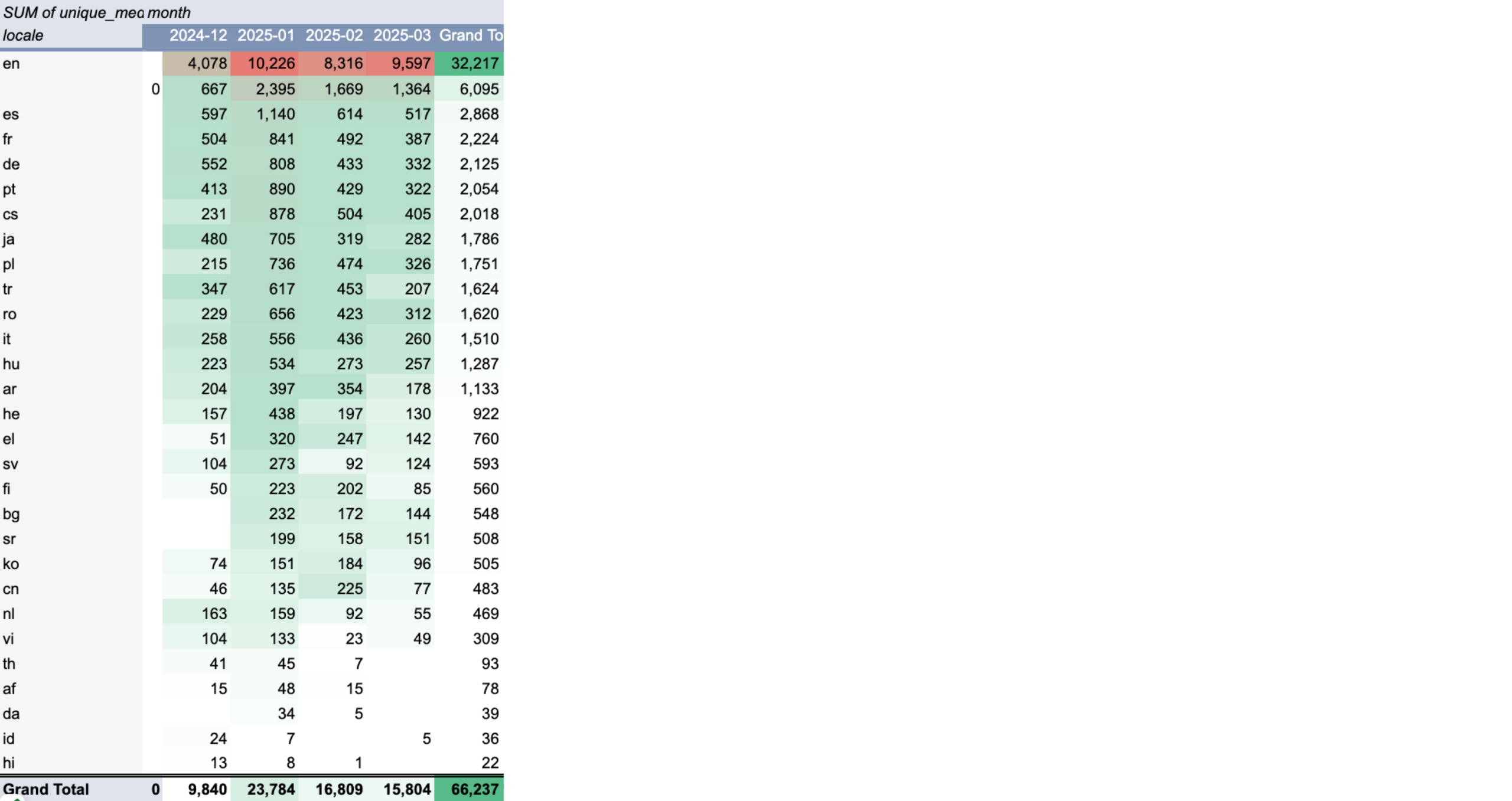

BetterMe actively localizes their top-performing funnels – but only after they’ve proven themselves in core markets. I looked at URLs and utm_content tags to map how creatives were distributed across localizations.

English leads the way

Around 58% of all unique creatives target English-speaking audiences – including the US, UK, Canada, Australia, New Zealand, and a general “Worldwide” geo. This is the foundation most funnels are built on.

Secondary geos give 3–5% revenue uplift per locale

Beyond English, the creative split looks like this: around 4% of creatives are in Spanish, 3% in French, and 2–3% in German and Portuguese. Smaller shares (1–2%) go to Polish, Czech, Arabic, Japanese, and Hebrew.

Each new locale typically adds 3–5% in additional revenue. Spanish alone opens access to Spain and Latin America; French brings in parts of Europe, Canada, and Africa. These aren’t primary markets, but they’re compounding layers that push total LTV up without needing new core funnels.

Scale first, then localize

BetterMe doesn’t localize funnels unless they’ve already shown strong results in English. A funnel gains traction in English-speaking markets first, and only then it’s localized into Spanish, French, German, and other languages. This helps BetterMe scale efficiently without wasting resources on unvalidated ideas.

UA & creative production system

BetterMe has built a repeatable framework for producing and scaling high-performing creatives. Each flow follows a modular structure: consistent hooks, messages, and visuals that are adapted for different segments.

500–1,000 creatives per flow per month

Across funnels, I saw anywhere from 500 to 1,000 unique creatives per flow per month, depending on theme and geo.

The same message is tested with different voiceovers, on-screen text, actors, and visuals – including studio shots, UGC, and animations. Each version targets a different type of user or explores a different angle.

Video is the default, especially for categories like calisthenics and yoga, where motion = relevance. But static images still make up a meaningful share in flows like fasting, meal planning, mental health, or style.

Content studio model

The entire content production process operates more like a high-output studio than a performance team. Creatives are built in families using shared templates and storyboards. AI handles voiceovers and swaps; copy and CTAs rotate in controlled test loops.

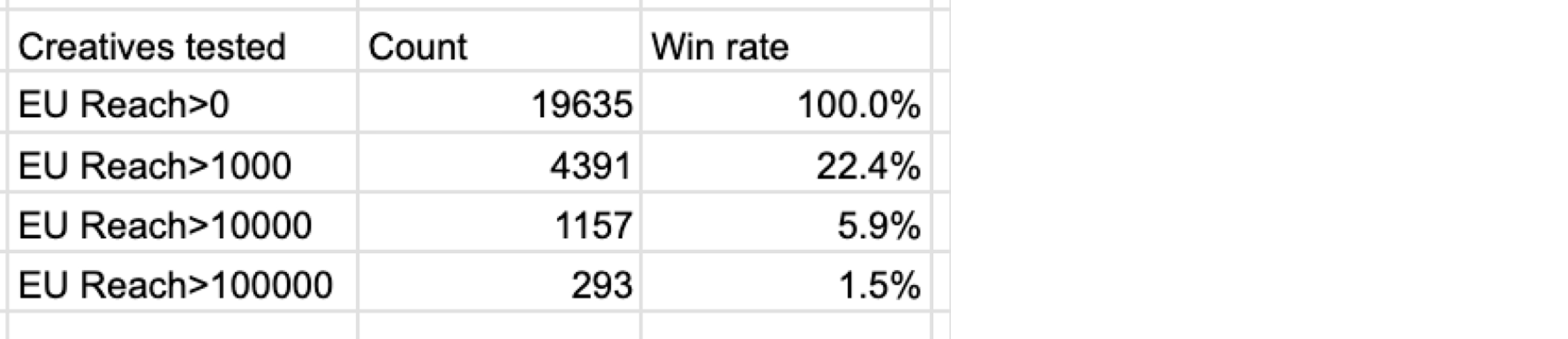

Only 1–2% of creatives make it

I define a “winning” creative as one that hits 100k+ impressions. Based on EU data (where Reach is available), BetterMe’s win rate is around 1.5% – for every 1,000 creatives tested, 10–15 will scale.

Winning hook patterns

Top creatives often follow the same structure:

- A time-based callout like “Starting Monday” or “Until June 1”

- A simple challenge: “10 minutes a day” or “Can you do 50 pushups?”

- A progress promise: “In 1 week you’ll feel it, in 2 weeks you’ll see it…”

Fan pages, pixels, and attribution structure

BetterMe runs many funnels at once, so they split delivery across different fan pages (or branded ad pages) and pixels. This helps keep things organized and gives more control over how ads are shown and tracked.

Fan pages are tied to each funnel

Each topic runs from its own page. For example, “Wall Pilates” for pilates-related flows or “Chair Yoga” for yoga. Some pages are branded around creators or ambassadors.

This approach likely helps reduce ad fatigue. Users may see different creatives from different pages, even when the underlying flow is similar.

There’s also a structural benefit: separating ad learning and engagement history by page helps avoid cross-contamination of performance signals.

One pixel per topic

Each funnel usually runs on its own pixel. Some topics share pixels, like calisthenics and gym workouts. In some cases, multiple pixels are attached to the same funnel. Possible reasons:

- Internal traffic splits (e.g., by gender, intent, or user tier)

- Attribution across partners or affiliate networks

- Segmenting by user behavior (high vs. low LTV cohorts)

The exact rules behind it aren’t public, but the structure points to large-scale testing and intentional, layered optimization.

Targeting logic

BetterMe runs structured targeting – campaign naming patterns show how they segment users by gender and by interests. They also apply different strategies depending on whether a funnel is new or already scaled.

Gender-based targeting

Most funnels are built separately for men and women. Visuals, messaging, and quiz logic often differ. For example, Wall Pilates has distinct flows for women and men over 40, with tailored creatives and body types. Flows like mental health are more often gender-neutral, but these are the exception.

Interests targeting

While most of the market sticks to broad targeting, BetterMe includes a significant share of interest-based campaigns. Campaign names indicate clusters like sleep, stress, HIIT, and fasting – a sign of ongoing testing around specific topics.

Lookalikes

Lookalikes appear mostly in early funnel launches, when there isn’t enough pixel data. They help launch campaigns, transfer learnings from similar flows, and create an early signal for Meta’s algorithms. Once a funnel starts converting, algorithms take over.

Bidding strategy

BetterMe doesn’t stick to one bidding strategy. Their utm_campaign structure reveals a wide mix – including Cost Cap, Bid Cap, Low Cost, and Value Optimization. This gives them flexibility to adapt to different flows and audience segments.

Cost and Bid Caps dominate

Only about 15% of their creatives use Meta’s default Lowest Cost bidding. The rest are spread across more controlled methods – mostly Cost Cap, Bid Cap, and combinations of the two. In total, these structured bidding strategies appear in over 60% of creatives.

Value optimization

In high-ARPU funnels, BetterMe optimizes for value. This method focuses not just on conversions, but on the expected value of each purchase, sending Meta extra data to help find more profitable users.

Split bids by audience

They also test multi-bid setups – setting different bids for different audience types like age or intent. This allows more control and reduces the risk of overlap or cannibalization between campaigns.

Key takeaways

Here’s what makes BetterMe’s system work and how it’s replicable (if you have the ops to support it):

- Wide network of web2app funnels. Each core topic – like calisthenics, fasting, or mental health – includes dozens of versions adapted for different audiences, regions, and creative angles. What starts as a single concept often becomes 50+ funnels.

- Localization of performing funnels. BetterMe localizes only proven funnels. English-speaking markets account for nearly 60% of creative volume, and new languages are added selectively, each bringing an additional 3-5% to revenue.

- Creative production & testing framework. BetterMe produces 500–1,000 creatives per funnel each month, testing the same message in different formats, voices, and visuals. Only 1–2% become winners. Video is the main format, but static images still play a strong role.

- Fan pages and pixel setup per funnel. BetterMe uses separate fan pages and pixels for each funnel topic, like Wall Pilates or Chair Yoga. This setup helps manage ad delivery and keep performance signals clean. Some funnels even run with multiple pixels – likely for traffic splits, partner tracking, or segment-level optimization.

- Structured targeting. BetterMe segments targeting by gender, interests, and funnel stage. Most flows are built separately for men and women. Interest-based targeting is used to reach specific segments. Lookalikes are used to kickstart new funnels before broader optimization takes over.

- Flexible bidding setup. BetterMe uses a mix of bidding strategies to manage cost and scale. Most campaigns run on Cost Cap or Bid Cap setups, while value-based and multi-bid strategies give them more control in high-ARPU or segmented funnels. Lowest Cost is used rarely, only in about 15% of creatives.