Payment orchestration helps you cut fees, boost conversion rates, and reduce risk by routing transactions smartly across multiple providers. It lets you move fast, experiment, and stay in control of how you charge and collect globally.

Still, a lot of founders and product teams assume it’s only for enterprise. Something too complex, too heavy, or just not worth the effort at the early stages. That’s a myth.

In a live session, Emilia Bayer, Growth Strategy Lead at Primer, and Andrey Shakhtin, CEO & Co-founder of FunnelFox, broke it all down — why you need payment orchestration, how to make it work even with a small team, and what you’re probably getting wrong about scaling payments. Here’s what we learned.

Why switch to your own payment stack in the first place?

The simple answer: control, costs, and customer ownership. Apple’s in-app payments come with a 15–30% fee. For some businesses, that’s just the price of convenience, but for startups that want to scale fast and stay lean, it’s a serious hit to margins. And control is still a rare thing — according to Primer’s latest report, only 9% of companies feel fully in control of their payments stack.

💡 Want more insights? Primer’s report shows how 150 fast-growing companies are dealing with payment challenges and what the best teams are doing differently. From missed conversions to rising fees and the risks of relying on one provider, it’s all broken down clearly, with real numbers and examples. If you’re building a payment stack for the long term, this is worth your time.

Running your own stack lets you cut those fees down to 1.5–6%, and more importantly, lets you own the customer relationship directly — something you don’t get when Apple processes payments for you. It also gives you the freedom to build payment flows that match your product strategy, instead of bending to platform rules.

The question is, how do you actually pull that off without building a complex payments team? That’s where payment orchestration comes in.

What is payment orchestration?

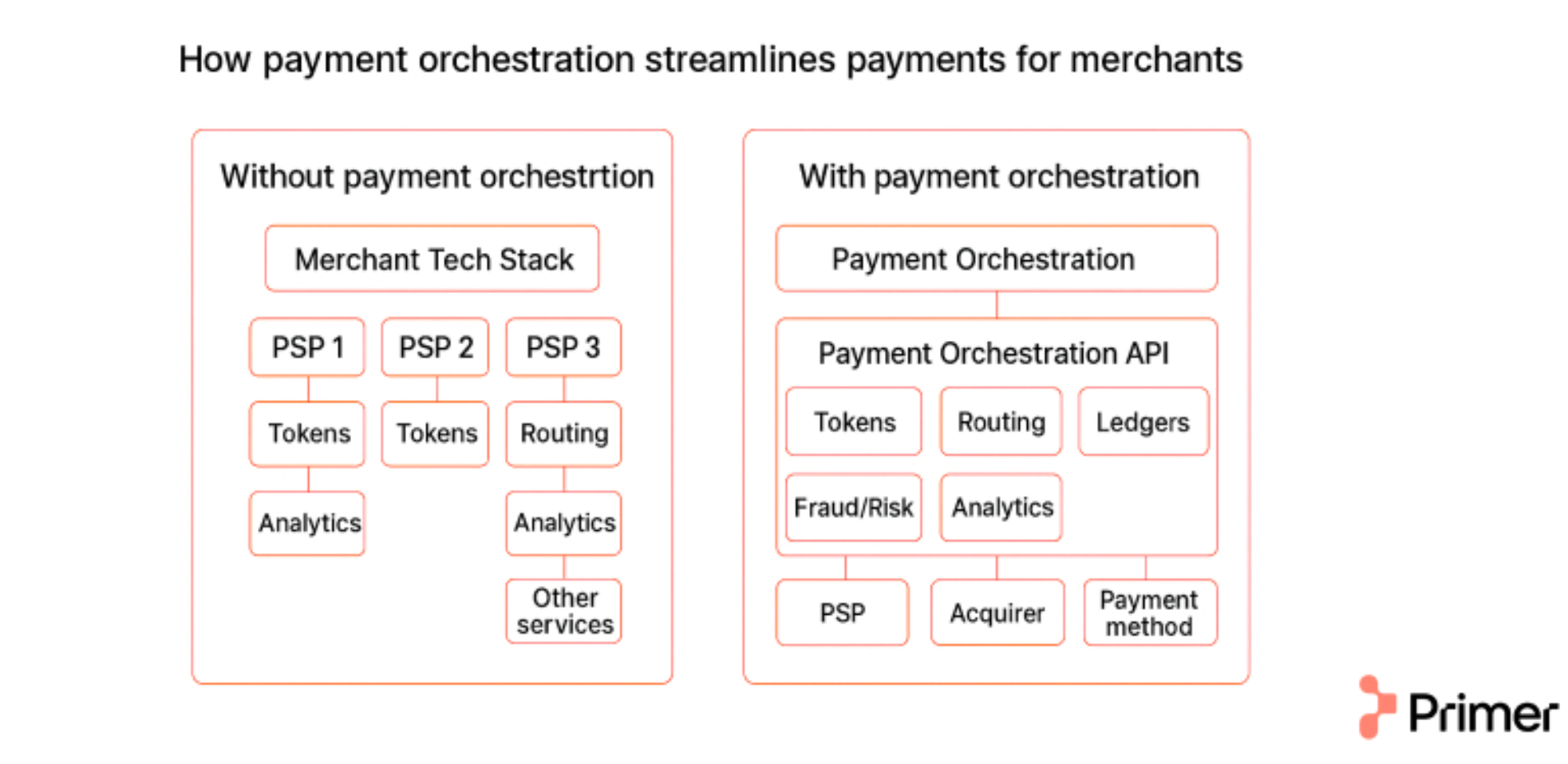

Think of it as a technical layer that pulls all your payment tools — payment service providers, fraud systems, data platforms — into one unified system.

Let’s say you’re using Stripe, Adyen, and Nube, each has its own checkout, rules, and analytics. You end up managing three stacks that don’t sync.

Orchestration fixes that. It brings everything together, harmonizes how tools interact, and lets you manage payments from a single interface. You get consistent logic, clearer data, and one source of truth across all providers.

How does payment orchestration work?

Let’s walk through what happens behind the scenes when someone subscribes on the web and how payment orchestration makes it all faster, smarter, and more reliable.

1. The user reaches checkout

Once a user is ready to subscribe, they’re taken to the checkout screen, where they choose a payment method — like a card, a digital wallet, or a local option.

2. Payment info is captured and sent

After the user confirms their purchase, their payment data is securely collected. The payments orchestration platform (POP) takes care of this step: it encrypts (tokenizes) the card information and sends the transaction to a payment gateway to move it forward.

3. The transaction is routed to a processor

This is where orchestration comes in. The payment orchestrator decides which payment processor to use based on predefined rules. If the initial processor can’t authorize the payment, the orchestration provider automatically retries the same transaction with another processor using a fallback mechanism.

Under the hood: what happens during routing

Behind this routing step, there’s more than a simple rule engine. The orchestrator may evaluate BIN ranges, issuer behaviour, region-specific approval patterns, card type, risk scores, and real-time performance metrics from each PSP. Soft declines trigger instant retries through a fallback provider, while hard declines stop the flow to avoid unnecessary friction. Network tokenization helps keep the credential valid even when the underlying card changes, and an independent vault can ensure your tokens are portable across processors—avoiding processor lock-in.

4. Authorization between banks

The acquiring bank (the one working with your business) sends the transaction to the issuing bank (the user’s card provider) to request authorization. If the new payment is approved, the authorization is sent back through the chain to confirm the transaction.

5. More successful payments, less friction

By using multiple processors and smart routing, payment orchestration providers helps businesses:

- Cut down on failed payments

- Increase success rates at checkout

- Reduce payment processing costs

- And deliver a smoother experience for every customer

In short: more revenue, less stress, and no more guessing which processor will perform best.

Is payment orchestration just for big companies? Not anymore

There’s a common belief that only large enterprises can afford to build and manage complex payment setups. But orchestration isn’t just for teams with 50 engineers and a dedicated department.

With no-code platforms like Primer, even small teams can start owning their payments orchestration layer. You don’t need to write custom code or maintain complex integrations. Someone from your finance or product team without a tech background can build logic, run experiments, and manage providers with a few clicks.

“You don’t need subject matter experts. You don’t need developers. You just need someone curious enough to experiment.”

— Emilia Bayer

Subscription apps need payment orchestration even more

For subscription-based models, payments aren’t a one-time event — they’re an ongoing negotiation between your product, the user’s bank, and every little thing that can go wrong in between. Renewal payments commonly fail silently: expired cards, issuer hiccups, soft declines, missing 3DS, mismatched MCC. And each failed charge becomes involuntary churn — the worst kind, because the user didn’t choose to leave.

A well-implemented payment orchestration layer gives you far better control over renewals: by connecting multiple processors, automatically retrying failed charges via a higher-performing provider, routing cards or issuers with weaker success rates to alternative paths, and using network tokenization so subscriptions keep running even when underlying cards change.

In practice, this means fewer silent churn cases, more recovered renewals, and a subscription revenue line that’s far less vulnerable to “one PSP has a bad day”.

What payment orchestration unlocks for apps with web-based payments

Web-based funnels are fast, but can be fragile: you spend money to bring a user to checkout, and one PSP becomes the single point of failure. A regional slowdown, issuer quirk, or random spike in declines can break the entire flow, even when nothing in your product or marketing actually changed.

Orchestration removes that dependency. Behind one unified checkout, you get multiple processors, higher approval rates across regions, and instant fallbacks that reroute failed payments without touching the user or interrupting the funnel. And here’s what this looks like in practice.

1. Smarter payment routing by geography and logic

With traditional setups, you rely on one PSP and take whatever terms they offer: fixed rates, generic logic, limited control. That’s a big risk when your conversion funnel lives on the web but needs to scale globally and move fast.

Orchestration layer flips that. You can plug into multiple providers and route transactions dynamically based on geography, performance, or cost. For example, send US payments to a domestic acquirer for higher approval rates, and LATAM payments to a local partner with better fees. All of it works through one unified checkout.

2. Instant fallback for failed transactions

If one provider declines a payment, the same request can automatically retry through a second one, with zero impact on user experience. That’s huge for subscription renewals and promo-driven funnels, where failed payments mean lost revenue.

3. A/B tests on PSPs without code

You can run experiments between providers, test different logic, and monitor conversion results, all from a no-code interface. No dev tickets required.

How payment orchestration reduces risk and protects your business

Some payment failures don’t come from users, cards, or PSP outages at all — they’re baked into the setup. A misconfigured MCC (merchant category code) can instantly drag approval rates down because issuers classify your business as higher risk. In Europe, skipping 3DS leads to guaranteed declines due to PSD2 requirements, while enabling 3DS everywhere else introduces friction you don’t need. Regional rules matter, too: Brazil expects PIX, India leans on UPI, LATAM often requires local acquiring for approvals to land, and U.S. debit routing works differently from credit.

When these fundamentals are off, no amount of marketing or funnel optimization can save the conversion. This is exactly where orchestration starts acting as a safety layer rather than just a routing tool.

And from here, the real failure scenarios begin.

When your main provider fails

If your mobile app relies on web2app funnels, losing access to your PSP is more than an inconvenience — it’s a full stop. And it’s not a rare case. There are plenty of instances where providers like Stripe abruptly terminate accounts, giving teams just a few days to respond and no clear path to continue charging existing users.

For subscription-based models, that means immediate revenue loss. Without access to saved payment credentials, there’s no way to recover ongoing billing, and switching providers fast becomes a nightmare.

Orchestration provides a safety net. With the right setup, payments can be rerouted to a new PSP instantly, without breaking the customer experience. Instead of scrambling to integrate new providers under pressure, you switch routes with a few clicks and keep your funnel running.

Pro tip: With FunnelFox Billing, you can reroute payments, store tokens independently, and recover failed transactions automatically — all from one place, with Primer’s reliability under the hood.

When you don’t own your tokens

When a PSP stores your tokens, they don’t just process payments — they effectively own your billing. If the provider updates its risk models, flags your traffic, or freezes the account, you lose immediate access to stored credentials. And because tokens are not portable across PSPs, you can’t simply “switch providers” — the entire renewal base becomes stuck on the processor you no longer control.

This is why rerouting alone isn’t enough. Payment tokens stored by your PSP put the customer relationship on their side, not yours — and when things go wrong, you have no leverage and no way to recover renewals quickly.

An independent vault breaks that dependency. It stores tokens separately from your processors, so even if your main provider shuts down, your billing logic and customer data remain intact. You’re free to reconnect, reroute, and recover on your terms.

When cards expire or payments silently fail

Another weak spot is cards that expire, change, or get lost. Every failed charge is a lost opportunity and a potential involuntary churn point.

Network tokenization helps fix that. These tokens stay valid even when the underlying card doesn’t. Payments keep flowing, support requests drop, and fraud risk goes down. It’s a quiet upgrade, but a meaningful one for subscription-driven apps.

This also improves performance: tokenized payments are often prioritized by issuers and come with higher authorization rates and lower fraud.

Fallbacks, token control, and network tokenization are available out of the box in Primer. You can connect multiple PSPs, store tokens in an independent vault, and enable network tokenization with no extra dev work. It’s infrastructure-level protection for your payments, designed to keep you in control no matter what happens upstream.

How Primer simplifies payment orchestration

Primer does many things, but it’s also a powerful payment orchestration platform, designed so anyone on your team can manage payments without writing a single line of code. You don’t need deep technical expertise, and you won’t break anything by experimenting.

It starts with the integrations marketplace, where you connect your PSPs, fraud providers, analytics tools, and wallets. Once your stack is in place, you move to the orchestration layer: building workflows that define how payments are routed, retried, or split based on your business logic.

Checkouts, fallbacks, routing, token control, A/B testing — it all works through a drag-and-drop interface. Whether you’re setting up market-specific logic or trying out a new provider, the system is built to move fast and adapt without developer support.

Want to see it in action? Emilia showed the full setup process during the webinar — watch the video below.

How to build a resilient web payment stack

1. Audit your current setup

Look at where payments are failing and why. What are your approval rates? Where do declines happen? Start with the data.

2. Ask the right questions

When choosing providers, dig deeper:

- What’s their performance in your vertical?

- Do they support fallback or token migration?

- How responsive are they when things break?

3. Know your market

When expanding to new regions, it’s critical to understand what your customers expect at checkout. In Brazil, for example, PIX is a standard payment option, and its absence can lead to drop-off. In the U.S., users expect to see options like PayPal and Apple Pay. Meanwhile, in Europe, 3D Secure (3DS) is legally required for online payments, and skipping it will result in declined transactions.

Each market comes with its own norms and regulations, and your orchestration setup needs to be flexible enough to account for those differences.

4. Avoid common traps

- Wrong MCC (Merchant Category Code): It defines your risk profile. Get it wrong, and you’ll face higher fees and lower approval rates.

- Unclear statement descriptors: This is what customers see on their bank statements. If it doesn’t match your app name or brand, expect more disputes and chargebacks.

- Skipping 3DS in Europe: 3D Secure is legally required for online payments. If you’re not using it, expect declined transactions, especially on cards.

Addressing these early saves time, revenue, and sanity when scaling.

Wrap up

Your payment stack matters more than you think. The right payment orchestration setup can reduce fees, improve conversion rates, and protect your business when things go wrong.

The best part is that you don’t need a dedicated payments team or months of development to make it happen. With orchestration platforms like Primer, lean teams can build flexible, resilient payment stacks to cut fees, improve approval rates, and stay in control as they scale. The earlier you build it right, the fewer problems you’ll have to patch later.

FunnelFox partnered with Primer to help app teams get more out of web payments. If you want to take full control of monetization, this is a great place to start.