Health and fitness is one of the largest app categories, and also one of the most competitive. New players enter the space every month, making it harder to get noticed, retain users, or build a sustainable business.

To explore what’s working today, we brought together Phil Carter (CEO and Founder of Elemental Growth, ex-Quizlet), Sam Ti (Product Growth Consultant, ex-AllTrails), Kirill Makarov (Founder of WebFunnels Club, ex-Zing Coach), and FunnelFox co-founder and CEO Andrey Shakhtin. They shared hands-on strategies across acquisition, funnel design, monetization, and retention with real examples from top-performing apps in the space.

This article breaks down the highlights from that session. Scroll to the end for the full recording if you’d rather watch than read.

How to stand out in the most competitive app category

There are over 100,000 subscription-based consumer apps across the App Store and Google Play, but fewer than 30 have reached a $1B+ valuation. Nearly a third of those billion-dollar apps are in the health and fitness space.

That sounds promising, but in practice, it’s the opposite. The bar is high, the space is overcrowded, and AI has made it easier than ever to launch lookalike products.

So, how do you break through?

Nail the value prop and go deep, not wide

The strongest teams don’t chase mass appeal. They solve real problems for well-defined user segments — with focus, depth, and a clear value promise.

Ladder, for example, built their product around real coaches. These aren’t just fitness experts — they’re influencers who already have an audience and know how to speak to it. Their content powers both acquisition and retention: they bring users in through TikTok and Shorts, then guide them through structured group workouts inside the app.

Runna took a different route. Rather than appeal to beginners or casual joggers, they zeroed in on users training for races — 5Ks, 10Ks, half-marathons. It’s a smaller segment, but highly motivated and willing to pay for tailored guidance. That sharp focus helped them grow quickly and eventually get acquired by Strava.

Segment deeply and build funnels around goals

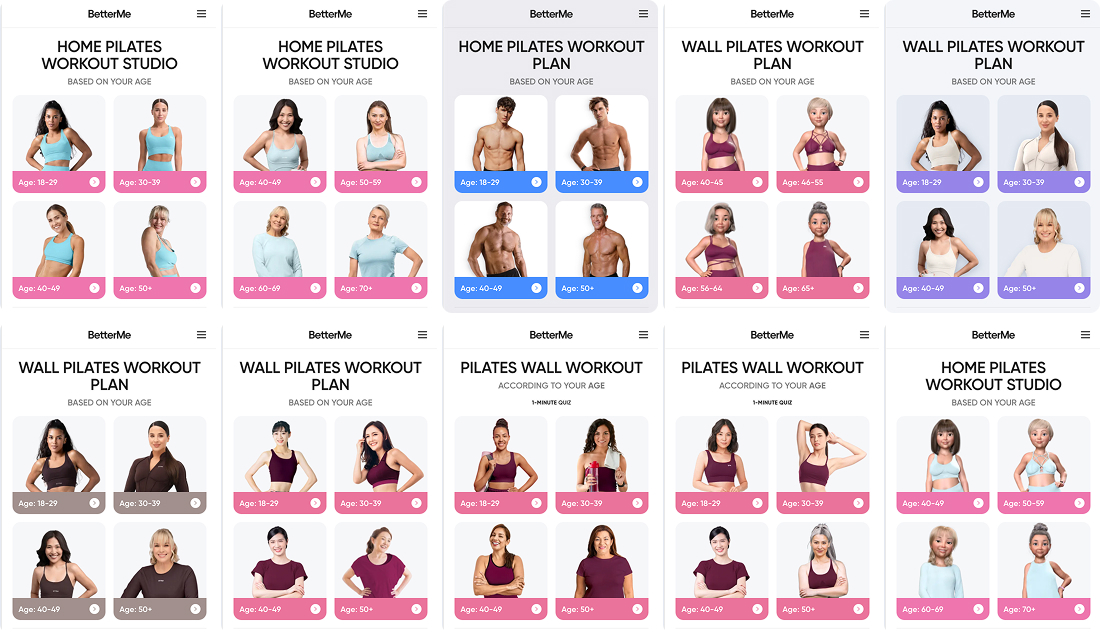

Apps like BetterMe and Simple don’t rely on a single onboarding path. They run dozens of separate web funnels, each tailored to a specific user type: men, women, seniors, yoga beginners, people trying to lose weight, build muscle, or simply walk more.

These funnels live on the web, not inside the app. Each one matches a different ad creative and quiz, and users only land in the App Store after they’ve already been segmented. This level of targeting isn’t possible with app store campaigns alone.

That feeling — even if built with templates — drives conversions. Many of these quizzes end with a predictive message like “you’ll see results in 7 days,” which reinforces the idea that the plan is personalized and grounded in data.

💡 Download our hands-on guide to web2app funnels to learn how to build, launch, and optimize high-performing flows.

Community as a long-term moat

In some cases, the users do the growth work. Communities form organically — Reddit threads, Facebook groups, niche forums — not because the company asked for it, but because the product hits a nerve. These peer groups become spaces for support, accountability, and motivation. When they form naturally, they’re incredibly powerful.

Paid and organic channels that still deliver

Despite all the talk of saturation, there’s still room to grow — especially through TikTok, YouTube Shorts, and UGC from real users and coaches. These channels can feel volatile compared to Meta, but the upside is higher, and competition is lower for teams that know what they’re doing.

Ladder stands out here, too. They monitor which influencer videos perform best, then turn those hits into paid ads. The user flow starts with a quiz on the web — not the app — and each quiz response contributes to a predicted LTV score. That score gets passed back to the ad networks, so campaigns automatically optimize for high-value users, not just installs.

Monetization in health and fitness apps: What works

Monetization in the health and fitness category is anything but one-size-fits-all. The category spans everything from mental health to strength training, each with its own user expectations, motivations, and willingness to pay, and that means different approaches to trials, subscription pricing, and product tiers.

Segment first, monetize second

High-LTV users who are already training regularly may respond well to a monthly plan. Low-motivation audiences who are drawn in by weight loss promises often churn faster and are better monetized through annual discounts. The more clearly a funnel segments its audience upfront, the more flexibility there is in pricing and positioning downstream.

This same logic applies to the channel. In-app monetization and web monetization often require very different tactics, especially when it comes to trial mechanics.

Transparency is the new table stakes

If your trial experience feels shady, users will bounce — or worse, complain. Clear reminders, easy cancellation flow, and upfront messaging have gone from nice-to-have to essential. Blinkist helped set this bar a few years ago, and it’s rippling through the entire category.

At AllTrails, the team shifted from low-price plans with poor retention to a 7-day trial that better qualified users. The trial itself became a core surface for testing — dozens of experiments on copy, visuals, and UX all revolved around that one upsell screen.

AllTrails also used web checkout aggressively — especially during seasonal campaigns — routing email traffic directly to the web to avoid store fees and increase LTV.

What AI changed

AI is starting to shift monetization models across the board, not just in health and fitness. Because AI features rely on large language models and third-party infrastructure, they often come with real usage-based costs. Every time a user interacts with an AI-driven feature, the app might pay per request, and that adds up fast.

Some apps are experimenting with AI-specific pricing: splitting subscriptions into a basic plan and an AI-enabled premium tier. Others, like Duolingo Max, introduced AI features as an entirely separate top-tier product. There’s also a growing trend of offering credits for AI-based features built into a plan by default, but expandable for power users.

Personalization pays off

When funnels adapt to user motivation and experience level, conversion rates improve and trial drop-off shrinks. More importantly, teams can better predict LTV and optimize spend accordingly.

One of the strongest examples came from Ladder, where the entire pre-paywall experience is built to segment and qualify users upfront. New users either entered through a specific coach or went through an onboarding quiz that matched them with the right one.

The quiz asks the usual fitness questions — goals, experience, workout frequency — but wraps them in dynamic copy and personalized feedback. Motivation screens and social proof adapt based on the user’s answers, reinforcing commitment and relevance every step of the way.

The team spent a full quarter reviewing every screen in the flow. That effort paid off: trial starts, retention, and paid acquisition efficiency all improved dramatically. Greg Stewart, CEO of Ladder, detailed this process on Phil Carter’s podcast.

What niches in health and fitness are growing fastest through web funnels?

Not every app category performs equally well on the web. Funnels built around high-intent, personal goals are seeing the strongest ROI and fastest growth.

Fitness sub-niches: Pilates, walking, calisthenics

Apps like BetterMe dominate this space with verticalized web funnels, one for each target goal and persona. These funnels don’t just segment users; they act as separate products with distinct creative, onboarding, and messaging.

Diet and fasting: Simple, Noom

Web funnels also work great when the product promise is immediate and specific, for example, “burn belly fat,” “lose 7kg in 30 days,” or “try intermittent fasting.” That’s exactly how Simple and Noom structure their acquisition — through goal-first quizzes with visual personalization.

Mental health and ADHD: symptom-driven flows

Web2app funnels are now gaining ground in mental health, especially for challenges like ADHD, anxiety, burnout, or procrastination. Users are willing to explore solutions in these areas, especially when funnels are empathetic and tailored to how they feel right now.

A note on kids’ health apps

Apps bought by parents for their children — like ADHD or movement coaching — are a growing segment, but they bring a specific challenge: the buyer is the parent, but the user is the kid. That means onboarding must win the parent’s trust and create a long-term line of communication.

And don’t ignore niche use cases on desktop

Sometimes the product itself just makes more sense on a larger screen — like map building in outdoor activity apps. In those cases, web usage is a feature, not just a funnel.

💡 Fast-track your funnel experiments. With FunnelFox, teams can build, personalize, and launch fully functional web2app funnels — landing pages, quizzes, checkouts, upsells — in just a few hours. The no-code builder makes it easy to match funnels to specific creatives, campaigns, or audience segments, with A/B testing and payment integrations built in.

What are the key growth drivers for health and fitness apps?

Creative is still the biggest growth lever, especially in paid acquisition. Large-scale teams treat creatives as a core part of their targeting strategy. With today’s algorithms, different ad angles attract different cohorts of users, so optimizing creatives changes more than conversion rates — it affects who ends up in your funnel.

With AI, the process has gone into overdrive. Runna, for example, produces 400 creative variations each month using tools like 11 Labs, Suno, and Veo 3 and reviews performance every two weeks.

AI helps in more ways than just speed. When Photoroom launched a background removal feature powered by AI, the response was so strong that CACs dropped significantly, making previously unprofitable regions like Indonesia, Brazil, and Mexico viable for the first time.

Formats vary — static, video, text. Phil notes the 400 count includes base concepts with multiple variants. At scale, 1,000 monthly assets is common, with about a third being variations.

But getting users in the funnel is only half the story. Intent-driven paywalls shown when users are most likely to pay can drive stronger retention than onboarding upsells. One example: if a user opened the same trail in AllTrails three times within 24 hours, they’d get a subtle prompt to download the map before heading out.

💡 Want to go deeper into AI for creative production?

We put together a practical guide on how top teams use AI tools like 11 Labs, Suno, and Veo for ad creatives at scale.

Download the guide here.

App localization: when, how, and why

Translating your app isn’t the same as growing internationally. Real localization that moves metrics goes far beyond switching the interface to another language.

At AllTrails, the team expanded from just English, French, and Spanish to 12 languages using automated tools. But what held them back wasn’t the tech — it was cultural nuance. German-speaking users, for example, said the app still “felt American” and preferred local competitors like Komoot, even when AllTrails had the better product.

Quizlet approached it with a different mindset. Instead of going all-in from the start, they followed a staged framework from ex-Tinder and TripAdvisor leader Ravi Mehta:

- Launch in English — get early traction and usage.

- Localize the chrome — nav menus, UI, error messages.

- Localize content — especially important for UGC platforms.

- Add market-specific features — only if ROI justifies the investment.

This lean approach works especially well for consumer apps: start with English-first marketing, test demand across multiple geos, then localize assets and product areas that show traction.

Why most fitness apps fail to retain and how to fix that

Retention is a use case problem. The biggest driver of retention in health and fitness apps isn’t gamification or habit-streaks — it’s the underlying motivation. If users don’t have a strong, recurring reason to return, even the best-designed app won’t save them from churning.

Some use cases are just stickier

Flo consistently outperforms others in retention — not just because of product quality, but because tracking a menstrual cycle is a recurring, unavoidable need. Compare that to generic weight loss, where motivation is fickle and easy to lose.

Runna shows similar strength by focusing on structured training goals — like marathon prep — which attract high-commitment users who are more likely to build long-term habits.

Community as a retention lever

Ladder designed its product around real-time group workouts and shared accountability. That group dynamic creates a sense of commitment and camaraderie — something solo fitness apps struggle to replicate.

Retention starts at the top of the funnel

Sometimes churn isn’t a product problem, but a targeting one. Teams that focus too much on increasing trial starts or lowering CAC often attract low-intent users who churn fast and poison long-term metrics.

Is it possible to build a profitable funnel for health and fitness apps in Tier-3 countries?

Short answer: yes, but don’t expect miracles.

Health and fitness apps can absolutely build profitable funnels in Tier-3 geos, but there are tradeoffs. The mechanics of monetization and onboarding are the same, but volume is lower, and scaling is harder. It’s not where you go to blitz your way to the top of the charts — it’s where you go to test, learn, and (sometimes) build a loyal base with less competition.

One good example: Meditopia. Instead of going head-to-head with Calm and Headspace in the U.S., they built traction in lower-competition markets like Turkey, relying on ASO and organic growth through low-competition keywords, not paid ads. This allowed them to avoid the rising CAC of mature markets and still climb the global charts.

Wrap-up

No two health and fitness apps grow the same way. Retention, monetization, and acquisition tactics all depend on the audience you’re building for. The best teams don’t chase trends. They build systems that let them learn faster and make decisions based on their own data.

Want the full conversation? Watch the full webinar recording below.