Project summary

- Challenge: Failed transactions undermined Shmoody’s revenue and user satisfaction.

- Solution: FunnelFox’s “payment failed” action that guided users to switch from prepaid to debit cards.

- Outcome: 20% of failed transactions successfully converted into completed payments.

Challenge

For Shmoody, one of the leading apps for mental health and habit tracking, smooth user experience is everything. But behind the scenes, a hidden problem was eating away at growth: a significant share of failed transactions, mainly from prepaid cards.

When these payments broke down mid-flow, users were left frustrated, and Shmoody lost revenue that had nothing to do with churn or engagement, but simply with friction in the payment process.

The team knew they needed a smarter way to address these failures — one that would guide users toward using the right type of card to complete their payments successfully.

Solution

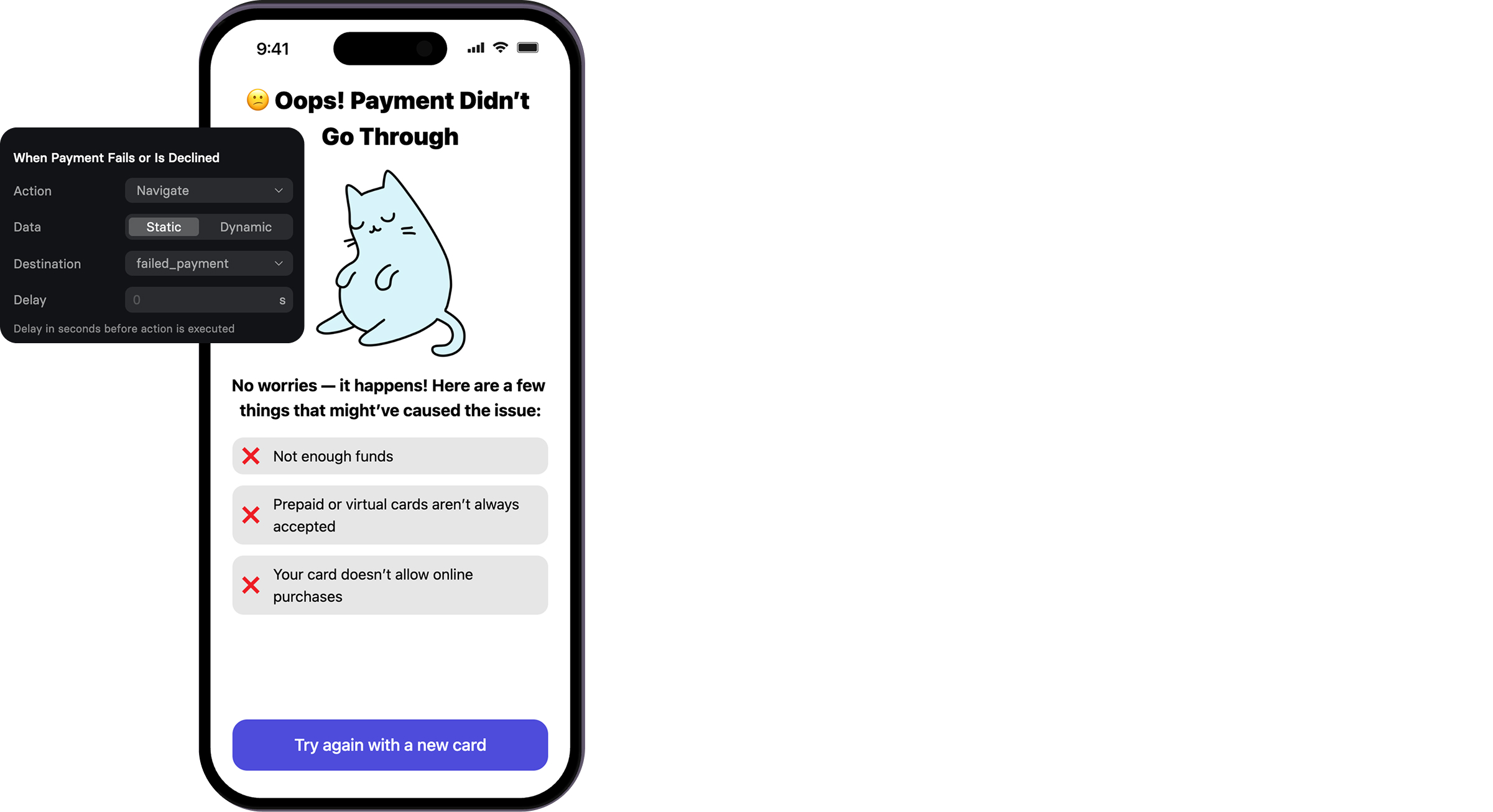

Shmoody integrated FunnelFox’s “payment failed” action directly into its payment flow.

When a prepaid card was declined, users were redirected to a screen explaining the reason for the failure, paired with a clear CTA to retry using a supported payment method (such as a debit card).

This seamless approach turned dead ends into opportunities for recovery.

Results & impact

In the very first week, Shmoody recovered around 20% of failed transactions, and optimization is still ongoing.

- 20% of failed transactions recovered

Beyond the numbers, the impact was broader: the app became more resilient, with fewer losses caused by avoidable payment friction.

For Shmoody, this wasn’t just a technical fix — it was a business win. A small tweak in the payment flow translated into meaningful gains for revenue, user experience, and long-term growth.

Shmoody & FunnelFox: A long-term growth partnership

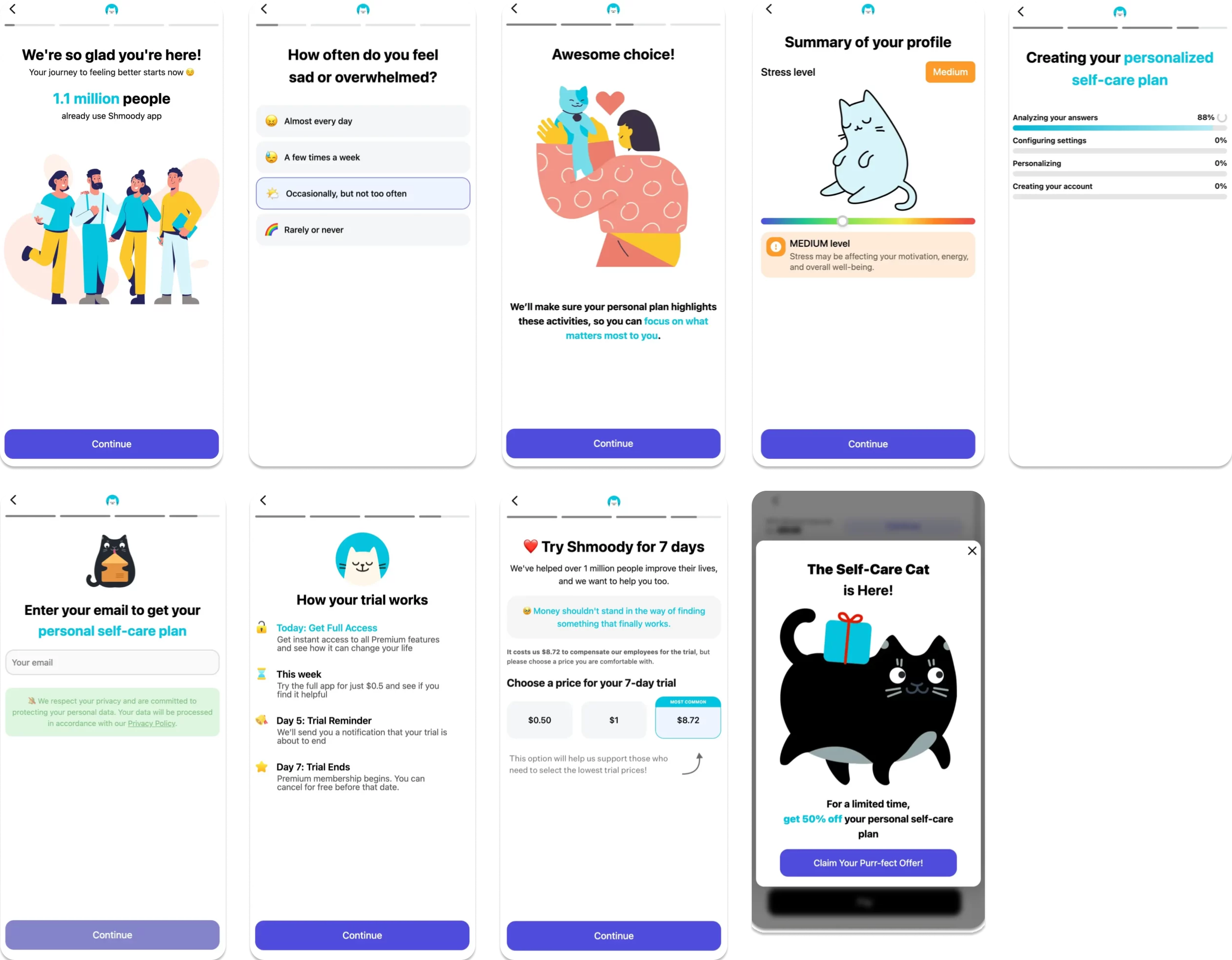

Shmoody has been a long-term FunnelFox partner, launching their very first web2app funnels on the platform.

Instead of spending months building onboarding, paywalls, checkouts, and testing infrastructure in-house, Shmoody relied on FunnelFox to manage the entire web2app journey. For the past few years, FunnelFox has been powering Shmoody’s web acquisition, enabling the team to scale experiments, optimize funnels, and capture intent-driven traffic outside the app stores.

As a result, Shmoody achieved an 80% increase in ROAS within just 3 months. Weekly A/B testing fueled continuous optimization, while web acquisition grew to 70% of their total UA budget, which doubled to $300k.

👉 Want the full picture? Read the full story of how Shmoody increased ROAS by 80% in just 3 months.