If you run a subscription-based app and charge users via the web, there’s one extra metric you can’t afford to ignore: dispute rate.

Unlike App Store or Google Play billing, where refunds are managed by Apple or Google and chargebacks are largely invisible, in web billing, you are the merchant of record. That means every chargeback hits your Stripe or Paddle account directly, feeds into your dispute rate, and influences how payment networks and processors view your risk profile.

The good news: most chargebacks can be avoided. In this article, we’ll unpack why they happen, why they matter, and how to prevent chargebacks to keep your dispute rate low.

Why chargebacks matter (and how they’re tracked)

Every chargeback is a red flag to your payment processor. Too many, and you risk a high dispute rate, which drags:

- Payout holds: Your funds get locked while your account goes under “review.”

- Volume caps: Providers can throttle how much you’re allowed to process each month.

- Potential bans: In extreme cases, payment providers can freeze or even terminate accounts.

And then there’s the hidden tax: chargeback fees, degraded trust with processors, and reputational signals that stick to your merchant profile.

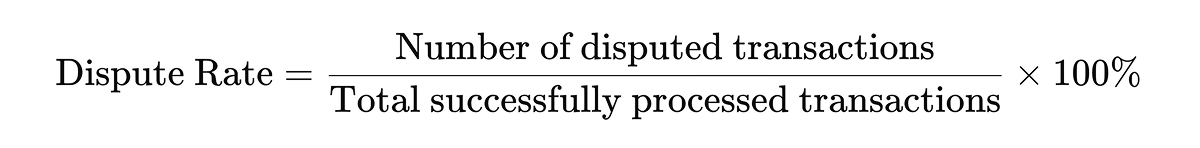

How is dispute rate calculated?

Processors like Stripe and Paddle track your dispute rate on a rolling 30–60 day basis. Here’s how it’s calculated:

For example, if you processed 10,000 transactions in the past month and received 40 chargebacks, your dispute rate is 0.4%.

Stripe typically flags accounts above ~0.5%, while Paddle tolerates up to ~1%.

Key nuance: Only settled transactions count, and declines and refunds don’t. And chargebacks stay “open” until resolved, which can temporarily skew your numbers. That’s why processors prefer rolling windows over single-day spikes.

What causes chargebacks in subscription apps?

To prevent chargebacks, you need to first understand what causes them. Chargebacks map directly to UX breakpoints where users feel out of control — cancellation flows, renewals, refunds, and support.

1. Dark patterns in cancellation flow

It’s tempting to reduce churn with friction-heavy cancellations like burying cancel buttons, requiring emails to support, or introducing multi-step exits. In practice, apps with hidden cancellation flows see more chargebacks, especially in the long run.

2. Unmanaged renewal expectations

Subscription renewals operate on a silent assumption: users remember they agreed to them. But they don’t: beyond 90 days, retention memory decays; and users don’t connect today’s charge with their original consent event.

Without proactive reminders or clear descriptors, renewals feel like unauthorized charges, even when fully valid. Stripe classifies this as “friendly fraud,” but it counts the same.

3. Slow or messy refunds

When users feel they’ve lost control over their money, chargebacks follow. A failed refund request that drags on for more than a week can drive chargebacks, even if it resolves eventually. Delay brings anxiety, and anxiety drives escalation straight to the bank, bypassing your support funnel entirely.

4. Support gaps in critical windows

The 24–48 hours after a charge are the “decision window” for chargebacks. If a user panics over an unexpected renewal and can’t reach support quickly, they file a chargeback instead. Apps that add live chat or async in-app messaging during this period cut dispute rate significantly without touching billing flows.

5 ways to prevent chargebacks in subscription apps

The only way to prevent chargebacks and keep your dispute rate low is to ensure users feel informed, in control, and able to reach help quickly. Here’s how you can do it.

1. Clarify subscription terms upfront

Many chargebacks start at signup when users misunderstand trial expirations or renewal cadence. Confusing pricing tables, hidden trial terms, and dense legal text set users up for future “I didn’t agree to this” claims. And vice versa, clear checkout flows that show charges and timelines upfront prevent chargebacks and reduce regulatory risk.

- Show billing timelines: Example: “Today: free trial starts → Day 7: first charge $X.”

- Add explicit renewal consent: Use clear checkboxes for “I agree to recurring charges”.

- Present pricing clearly: Show monthly vs annual side by side to prevent “unexpected amount” disputes.

Tip: Visa’s Compelling Evidence 3.0 (CE 3.0) rewards merchants who capture clear consent and user activity logs. For subscription apps, this means that clear renewal terms and post-billing login data can automatically overturn “friendly fraud” chargebacks in your favor.

2. Make every charge recognizable

Confusing billing descriptors are the #1 source of “unrecognized charge” disputes.

- Set clear payment descriptors: Update your processor (Stripe, Paddle) to display “AppName Premium” instead of cryptic codes like “PAYMENT*394812.”

- Test how it renders: Check statements across major banks (e.g., Chase truncates at 20 chars, AmEx doesn’t).

3. Set transparent refund policies

Transparent policies create trust. When users know refunds are accessible and fast, they resolve issues with you, not Visa.

- Publish clear policies: Keep them simple and linked from checkout, receipts, and support pages.

- Automate fast refunds: Set SLAs (e.g., <7 days) to avoid “waiting too long” chargebacks.

- Track refund pain points: Monitor refund-related tickets to spot recurring friction.

4. Make refunds easy to request

Clear refund paths prevent chargebacks, build trust, and show users you handle issues fairly, protecting both the relationship and your reputation.

- Show refund contact info: Include it at checkout, in receipts, and within account settings.

- Embed in-app support: Add chat or messaging so refund requests stay in your funnel, not at their bank. Make sure to respond fast to these requests — the first 24–48 hours post-charge are the decision window for chargebacks.

- Use pre-built refund templates: For high-risk cases (“I didn’t authorize this,” “I want my money back”), respond with ready-made messages that offer instant refunds or credits before they escalate.

5. Integrate chargeback prevention tools

Here’s a pro: use card-network alerts to stop chargebacks before they hit Stripe or Paddle. Tools like Merchanto, Ethoca, and Verifi notify you when a user has gone to their bank, so you can refund them first and keep it off your dispute rate.

- Plug into the networks: Merchanto, Ethoca, or Verifi connect straight to Visa and Mastercard’s dispute systems.

- Jump on alerts fast: When one comes in, refund it before it turns into a formal chargeback.

- Track the impact: This keeps your dispute rate clean and avoids the “monitoring program” headache entirely.

Manage everything in one place with FunnelFox Billing

FunnelFox Billing keeps you ahead of chargebacks with real-time dispute prevention across all your payment methods and providers.

- Instant alerts: Get notified of potential chargebacks so you can resolve issues before they escalate.

- Unified dashboard: Track all chargebacks and cancellations in one place, across every payment provider.

- Refund and cancellation management: Quickly handle refunds and cancellations to minimize disputes.

- PayPal chargeback prevention: Integrated tools help you manage PayPal disputes before they impact your account.

FunnelFox Billing also streamlines subscription management, automates revenue recovery with smart retries and payment cascading, and gives you full control over billing tokens for seamless provider switching. With everything in one platform, you reduce failed payments, keep your dispute rate low, and make your subscription revenue more predictable.

Wrap up

Stripe and Visa may track the number, but for you, the dispute rate is a product metric. Treat it as a health check that reflects your billing, UX, and support flows.

To prevent chargebacks and keep your dispute rate low, focus on:

- Recognizable charges: Clean payment descriptors instantly connect users to your brand.

- Clear subscription terms: Show renewal timelines and get explicit consent upfront.

- Easy refunds: Make refund paths obvious and fast to defuse frustration.

- Responsive support: Answer billing tickets in the first 48 hours.

- Chargeback prevention tools: Use card-network alerts to resolve disputes before they’re logged.

Keep these basics in place, and your dispute rate shifts from a risk signal to a sign that your product, billing, and support are working exactly as they should.