Trials are widely treated as the standard in subscription monetization. They boost conversions and feel like the safest path to growth. As a result, most subscription funnels are built around trials by default and optimized for them.

The problem is that conversion mechanics and subscription revenue drivers are not the same thing. What helps a user enter the product doesn’t necessarily help the business make money. In practice, most revenue is generated by a very different group of users than the ones funnels are usually designed for.

In this article, we’ll break down why the trial-first approach is so often overvalued, where subscription revenue concentrates, and how this should change your monetization strategy.

TL;DR

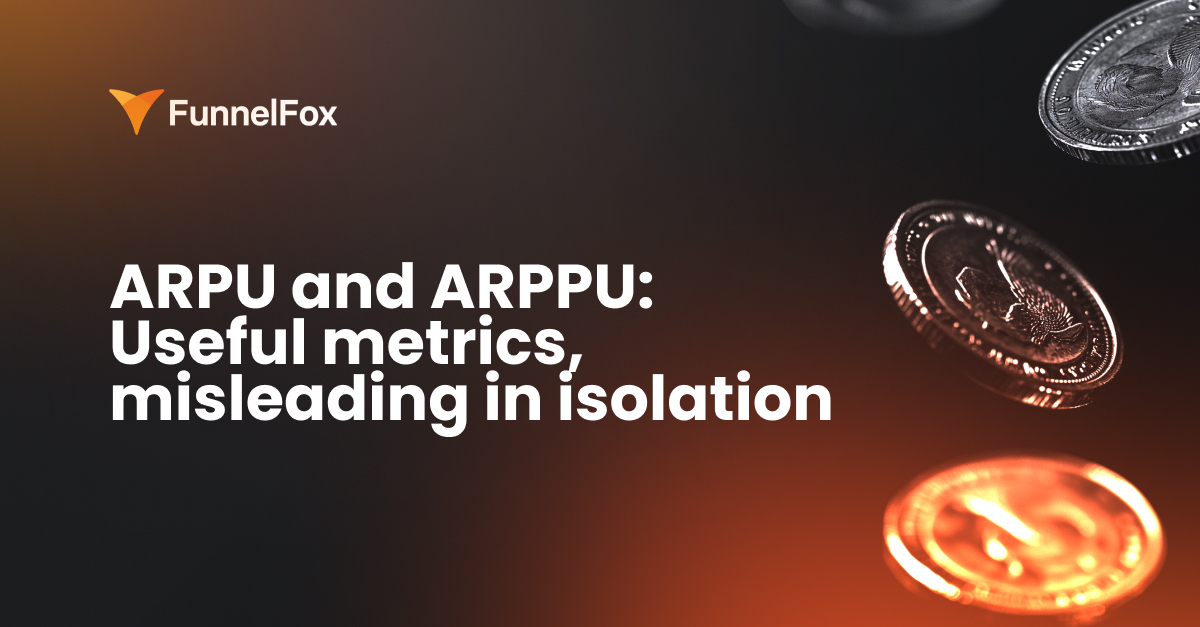

Most subscription revenue (56.9%) comes from users who pay upfront, not from trials.

Revenue is driven by high-intent users. The faster the decision is made, the higher the LTV. Delaying that decision through a trial almost always reduces user LTV.

Trial-first funnels carry hidden costs: delayed cash flow, more complex lifecycle management, and unnecessary friction for users who are already ready to pay.

Upfront monetization and web2app change the economics. The decision and the payment happen earlier, user LTV grows, attribution becomes tighter, and revenue turns into the primary optimization signal.

Why trials became a revenue trap

A trial-first approach feels like the logical choice: it lowers perceived risk for the user and looks good in early metrics. And that’s exactly why it so often works against subscription revenue.

First, trials are treated as a default best practice

Historically, trials were positioned as an easy entry. The issue is that a trial is basically a postponed decision, and in most cases, that means the user hasn’t fully gone through the cognitive path to value.

The result is predictable: trial cohorts start strong but deliver weak LTV.

Second, teams automatically equate lower friction with higher revenue

That’s a logical mistake. Lower friction increases conversion into something, not necessarily into money. Trials reduce the psychological barrier, but at the same time they attract users with low urgency and weak intent. They reinforce “I’ll think about it” and create a sense of temporary ownership without payment.

Third, trial performance is easier to see than revenue concentration

This is a pure analytics problem. Trials look great in dashboards: trial start rate, trial-to-paid conversion, D7 and D14. Those numbers are visible fast and easy to track.

But to see that no-trial users generate the majority of subscription revenue, you need cohort-level data, cumulative LTV, a split by entry path (trial vs no trial), and a longer time horizon — 60 to 180 days.

This creates a natural bias toward optimizing what is immediately visible, even before teams understand where revenue concentrates.

And finally, industry narratives reinforce trial-first thinking

Public case studies usually focus on increasing trial conversion rate, reducing friction, or giving users more for free. Much rarer are stories about losing install volume after removing trials and still growing revenue.

There’s also a cognitive bias at play. Trials feel friendly, and upfront monetization feels aggressive.

These narratives hold up only as long as teams look at conversions instead of cohort-level revenue. The moment the focus shifts from entry metrics to money, it becomes clear that a trial-first approach delivers very different results than expected.

The data shows that subscription revenue is not distributed the way most teams expect

56.9% of subscription revenue comes from users with no trial

More than half of total subscription revenue comes from users who pay without a trial. Trials are still part of the picture, but they account for a smaller share of the money: paid trials generate 28.9% of revenue, while free ones contribute just 14.3%.

No-trial offers consistently outperform trial-based flows across plans

The pattern is consistent across subscription lengths, from short-term to long-term plans. The no-trial path remains the largest source of revenue across weekly, monthly, quarterly, and yearly subscriptions.

As plan duration increases, the gap widens. Users who pay without a trial are more likely to commit to longer plans, while the revenue contribution of trial-based flows declines.

These charts come from the State of Web2App Report 2026 by FunnelFox. For more insights on how app-first and web2app funnels compare, how pricing and plan length impact LTV, and where teams most often lose and recover revenue, download the full report.

Taken together, the data points to two conclusions:

- Most subscription revenue is driven by users who arrive with a clear intent to pay.

- Decision speed directly correlates with user value. The earlier the payment is made, the higher the user’s long-term revenue contribution. By postponing that decision, trials may increase top-of-funnel volume, but they more often reduce overall user value.

One clarification matters here: these results don’t mean trials are useless. They mean trials solve a different problem than the one teams usually assign to them.

What trials are actually good at

Increasing conversion volume

Trials almost always increase top-of-funnel conversion volume, that’s their core strength. When users don’t have to decide away, they’re more likely to install, complete onboarding, and make it into the product.

As a result, conversion rates rise, but the underlying work does not disappear. Trials increase entry volume and shift the payment decision further down the funnel, where revenue has to be earned later.

Reducing initial hesitation

Trials are effective at reducing the perceived risk of making a wrong choice. This is especially useful in categories where the product feels new or unfamiliar, the value can’t be explained in a single screen, or the user isn’t yet convinced the problem is real or worth solving.

There’s a trade-off, though. By reducing fear, trials also reduce the weight of the intent. Users enter in an exploratory mindset rather than with a clear intent to commit.

Helping low-intent users experience the product

Trials work well for users with low or unformed intent. They give these users a chance to understand what the product is, check whether expectations match reality, and decide whether there’s real value at all. This helps educate the market and expand the audience.

But these users rarely become high-value subscribers — they cancel more often, choose shorter plans, and are more price-sensitive.

Supporting acquisition efficiency in some segments

In certain segments, trials genuinely improve acquisition economics: cold traffic, broad audiences, performance channels with high CPA, or regions with low upfront payment readiness.

In these cases, trials increase install-to-action rates and can reduce CAC.

But this is acquisition optimization, not revenue optimization. When teams don’t separate these two goals, trials start to look effective right up until they open an LTV report.

What trials don’t do well

Drive the majority of subscription revenue

Revenue rarely concentrates in trial users, even when most users pass through a trial.

The reason is simple: trials optimize entry, not payment. They increase the number of users who could pay, but they don’t increase willingness to pay more or stay longer, and teams see trial metrics improve while revenue growth hits a plateau.

Capture high-intent demand efficiently

Trials perform poorly with users who are already ready to buy. For high-intent audiences, a trial slows down the path to payment by adding an unnecessary step and reduces urgency.

Instead of a fast commitment, users are encouraged to delay the purchase. Some high-intent demand is lost or spread across the trial period, lowering both average price paid and subscription length.

Provide fast revenue signals

Learning happens later in the trial-first funnels. Teams don’t know whether the value proposition works when the user arrives — they find out a week or two later, after conversion or cancellation. Hypotheses get validated slowly, delaying financial feedback.

This is especially painful at scale. When a large share of users sits in trial, the company operates on promises of future billing rather than actual cash. That reduces financial flexibility and makes growth more fragile.

Scale revenue without operational cost

The entire user lifecycle becomes more complex due to additional states — trial started, ending soon, converted, canceled. Each state requires its own product logic, messaging, and edge-case handling.

At scale, this complexity increases operational costs: more users in support, more lifecycle communications, higher product load, and more churn once billing starts. Teams end up spending significant resources on users who haven’t yet generated revenue, while costs grow faster than revenue from trial conversions.

Conversion metrics vs. revenue reality

Conversion metrics create a sense of control over the funnel, but they do a poor job of explaining how real subscription revenue is actually generated.

Trial conversion rates look healthy

At the dashboard level, everything looks fine: onboarding doesn’t break, trial-to-paid conversion sits within benchmarks. It signals that the strategy works, and touching it feels risky.

The problem is that these metrics answer the question how many users reached payment, not how much money they ultimately generated. Strong trial conversion can coexist with short subscriptions, early cancellations, weak upsell performance, and low cumulative LTV.

Revenue contribution tells a different story

Once teams start looking at cohort-level revenue, the picture changes quickly. Trial users pay less, churn sooner, choose shorter plans at the start, and rarely upgrade from short-term to long-term subscriptions.

Turns out that most revenue comes from a small group of users who never went through a trial at all. That’s an uncomfortable insight because it calls months of work into question.

Teams optimize what they can easily measure

This is a systemic mistake. Trial metrics are immediately available, fit neatly into standard reports, and respond quickly to changes.

Revenue metrics lag behind, require detailed analysis, and are harder to interpret. They also often conflict with growth goals tied to volume and speed.

As a result, teams optimize what they can measure in 7–14 days, even when it harms subscription revenue over a longer horizon.

That’s where most monetization mistakes happen

The same pattern drives the most expensive mistakes:

- scaling trials without understanding who they bring in,

- declaring a paywall working based on conversion instead of revenue,

- avoiding any changes to trials out of fear that everything might drop.

In practice, the opposite happens. Teams spend months polishing trial flows without realizing that the primary revenue driver lives in a different segment of the audience — and no one is optimizing for it.

Why upfront monetization is more effective

Because it moves the decision point ahead of product usage. This directly affects audience quality, feedback speed, and subscription economics.

Users self-qualify before paying

No-trial path automatically filters the audience: users pay only if they recognize the problem and believe the product is the solution. Users therefore enter the product with their internal decision already made. This reduces noise, churn, and team load without additional filters or complex logic.

Revenue signal is immediate

Upfront monetization delivers the most honest signal a team can get: whether the market is willing to pay for this right now.

Every entry results in a binary outcome — payment or rejection.

That signal is rarely comfortable, but extremely effective. Teams learn faster what works and what doesn’t, and stop hiding behind proxy metrics.

Clearer feedback for pricing and offers

In a trial-based model, pricing gets validated indirectly and with delay. In an upfront model, validation happens immediately and directly.

This creates clean feedback: whether the price is too high, whether the value is clear, and whether the offer matches the expected outcome. Pricing mistakes surface faster, and adjustments produce more predictable results.

Better alignment between intent and monetization

In a trial-based model, intent and monetization are separated in time. In an upfront model, they align at a single point: the user arrives with a goal, pays, expects value, and then uses the product.

That alignment leads to longer subscriptions, lower churn, and higher LTV.

Case in point: Prehab’s Black Friday campaign

During Black Friday, Prehab replaced its free-trial flow with a direct annual offer. Conversion peaked at 4.5% and averaged ~3% — on par with historical trial funnels — but instead of delayed trial revenue, the team captured the full $149 annual value on Day 0.

The result: no conversion loss, higher immediate LTV, and zero reliance on future trial-to-paid conversion. Read the full story.

How web2app changes the picture

In a direct-to-app model, selling upfront without a trial has always been difficult. App Store flows and in-app onboarding are poorly suited for forming a purchase decision: users don’t yet understand the value, the payment context is constrained, and the offer either comes too early or gets pushed out. On top of that, app stores limit how teams can experiment with their monetization strategies.

Over time, trials became the default because there was no better option.

Web2app changes that.

Payment happens before or alongside install

Web2app breaks the install-first, decide-later flow. The subscription is purchased before installation, when intent is at its peak, which fundamentally changes user behavior:

- users install the app as paying customers,

- expectations around outcomes are set in advance,

- the product shifts from something to try into a tool for a specific job.

For subscriptions, this is critical. Value is established before usage begins.

Attribution ties directly to revenue

In web2app, subscription revenue is tied to the source immediately.

Not install → trial → maybe conversion, but click → decision → payment.

This removes one of the biggest blind spots in mobile monetization: optimizing acquisition around events while revenue shows up later and only in aggregate.

Teams start to see clearly:

- which channels bring users who are ready to pay,

- which creatives sell, not just generate clicks,

- where CAC pays back and where it only looks good on paper.

Funnels capture ready-to-pay users

Instead of pulling users into a trial and postponing the purchase, web2app funnels force it to happen upfront. Companies attract users who have already committed to buying, not users who are still evaluating whether they should.

Subscription revenue becomes the primary optimization signal

Campaigns start optimizing for payment instead of funnel entry. Low-intent traffic gets filtered out early, and audience quality improves at the point of entry rather than being fixed later through onboarding and trials.

There are fewer bling spots, a shorter learning cycle, and a direct link between acquisition and revenue.

Build revenue-first funnels with FunnelFox

FunnelFox provides the infrastructure to explore alternative paths and test monetization beyond trial-first.

It’s a no-code web2app platform for subscription-based mobile apps that lets teams move payment to the web and experiment with no-trial or hybrid flows without touching core app logic or waiting for store approval.

Because payment happens before install, teams see real revenue signals early — who pays, for which plan, and from which traffic source. This simplifies testing pricing, offers, and framing, and optimizing funnels for payment and revenue, not trial metrics or top-of-funnel proxies.

Want to explore alternative monetization paths and see how no-trial or hybrid scenarios perform in your app? Book a demo.

Wrap up on subscription revenue

Most subscription apps don’t make money because of trials — they make money despite them.

Trials are effective at scaling entry and reducing fear, but they don’t lock in a decision, and it’s the decision that ultimately determines revenue, LTV, and business durability.

Subscription revenue comes from high-intent users who are ready to pay upfront, and the faster the purchase is made, the higher the user’s value.

Web2app changes the game. Decisions and payments happen earlier, attribution becomes tighter, and revenue turns into the primary optimization signal. This restores control over monetization — without default assumptions, and with the ability to deliberately choose where trials help and where they hurt.