Apple’s old model may have had strict rules, but at least it had clarity. In 2026, the days of predictable 15% or 30% are over: after EU regulators enforced the Digital Markets Act (DMA), Apple replaced its flat commission with a layered fee system where the final cost is shaped by the payment path, user type (new vs. existing), and level of App Store services used. These factors can stack and push Apple’s take well beyond what most developers expect.

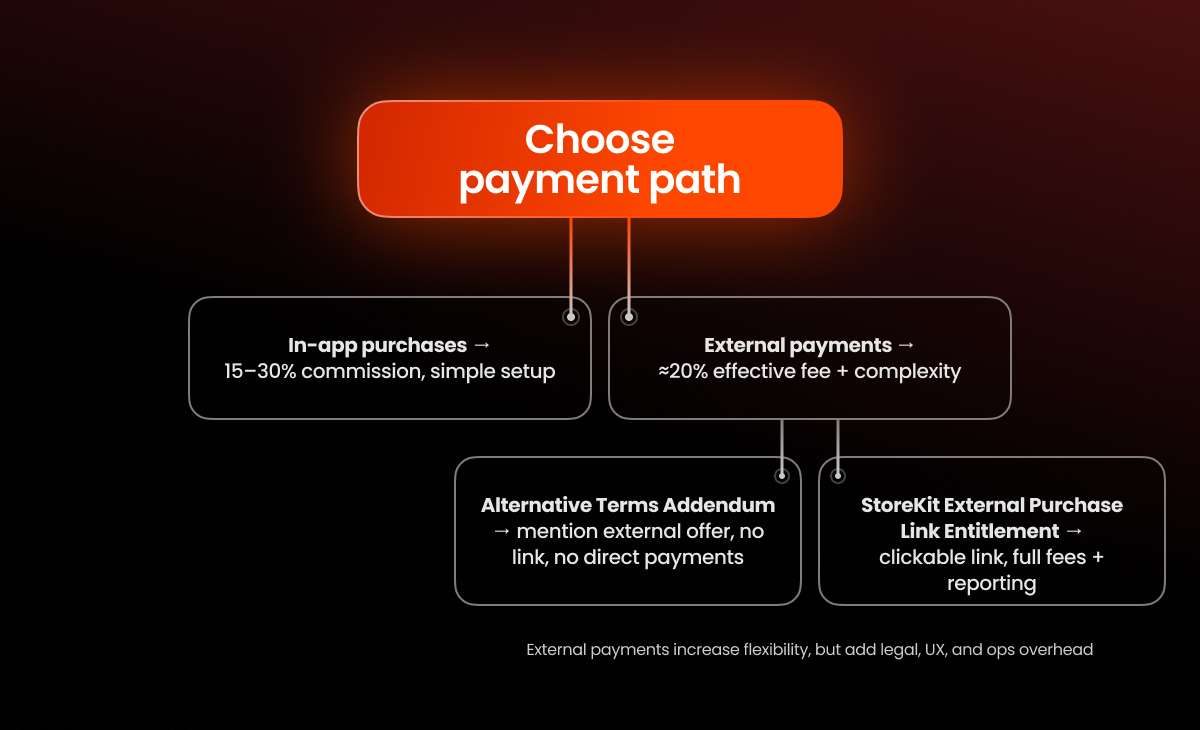

Apple also now formally allows external payments, but only under narrow frameworks. Depending on whether you link out, refer, or stay in-app, you’ll face different combinations of costs, rules, and reporting burdens.

So in the EU, there’s no single Apple fee anymore, just a fragmented system of options, each with its own trade-offs. In this article, we break down how the new fee structure works, why alternative payment methods are not always cheaper in practice, and what materially changes for developers as the new system fully takes effect in 2026.

How Apple App Store fees work in 2026: The old model vs the new reality

With the new modular fees system, the total cost for a developer can include different components depending on the chosen setup:

- access to App Store services (distribution, trust, tooling)

- the App Store’s role in user acquisition

- use of Apple’s core platform and technologies

On paper, there’s more flexibility than ever — in-app purchases, external payments, outbound links, different service tiers. In practice, each option adds another layer to the cost structure and changes the final outcome.

What used to be a straightforward pricing model is now a configuration puzzle where the final cost depends on your monetization setup, and the price of the wrong move has never been higher.

| Before (pre-DMA) | After (post-DMA, EU) |

|---|---|

| Single commission (15–30%) | Multiple components: Store Services, Core Tech, UA, Reporting |

| Predictable, fixed structure | Conditional and variable, based on business model |

| Same rules globally | Region-specific logic (EU ≠ US ≠ ROW) |

| Simple developer obligations | Complex reporting and compliance requirements |

| % fee easy to model and forecast | Effective cost hard to predict upfront |

How App Store fees changed in 2026

What triggered all this? In short: regulation.

The shift began in Europe, where the Digital Markets Act forced Apple to open up its ecosystem, allowing alternative payments, external links, and more flexible service tiers. But instead of replacing the old model with something simpler, Apple introduced a menu of tightly scoped options, each with its own pricing and constraints.

As a result, developers no longer choose whether to pay Apple — they choose what to pay for, and in which combination.

External payments don’t mean that App Store fees are gone

The introduction of external payments is often seen as a major win for EU developers. But can they flip the switch and return to clean, predictable economics? Not quite.

External payments aren’t an exit from Apple’s system, but an entry into a more complex configuration of it. What you gain in flexibility, you pay for in complexity:

- engineering overhead — separate payment flows, maintenance, fraud prevention, ongoing updates

- legal and compliance burden — local regulations, reporting, and liability for payments

- UX friction — leaving the native App Store flow, lower conversion rates, and trust concerns

So while the structure may look more open, the reality is that most choices come with hidden downsided that cancel out the savings.

Let’s look at how Apple EU App Store fees are structured now:

| Fee Type | Rate | Applies to |

|---|---|---|

| Initial Acquisition Fee | 2% | First 6 months of payments from new users |

| Store Services Fee | 5% or 13% | Based on the selected service tier (Tier 1 or Tier 2) |

| Core Technology Fee | 5% | Applies within 12 months of install, update, or reinstall |

In the most comprehensive setup, these components can stack, bringing Apple’s total take on external payments up to roughly 20%, compared to the standard 30% commission under in-app purchases. But in practice, the added engineering, compliance, and UX costs often erase or even exceed that 10% difference, so the savings exist mostly in theory.

If you still want to let users pay outside the App Store, Apple offers two tightly scoped options:

- Alternative Terms Addendum allows apps to reference external offers without enabling direct payment actions. You can inform users about subscriptions or promotions available elsewhere, but cannot include clickable purchase links inside the app.

- StoreKit External Purchase Link Entitlement enables direct, clickable links to external payment destinations. This path offers more flexibility in directing users outside the App Store, but it also triggers the full fee stack and additional reporting obligations tied to external transactions.

Both options technically open the door to external payments, but neither offers true independence from the Apple ecosystem.

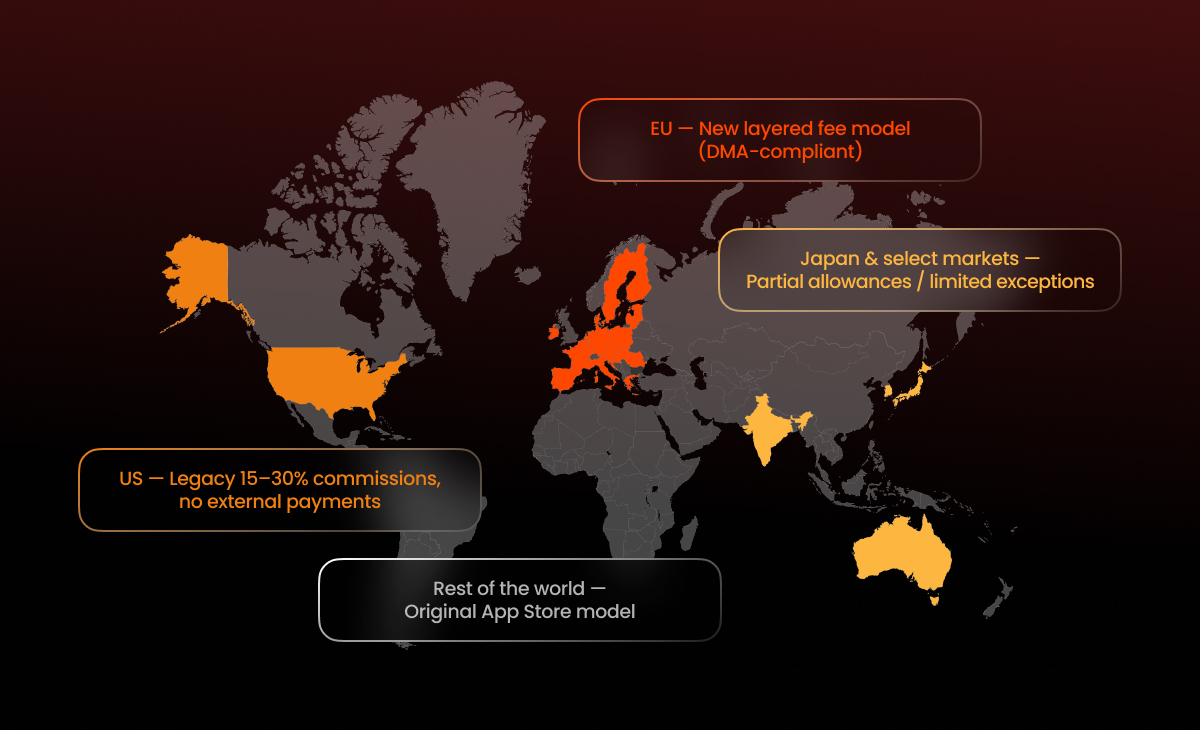

The systemic consequence: Monetization is now fragmented by region

Even if you stick to in-app purchases, the landscape has changed: monetization rules now vary by region, and the same app no longer runs on a single economic model.

In the EU, developers face a completely new fee structure — layered, conditional, and tightly regulated under the DMA.

In the US, the old model still holds: in-app purchases, 15–30 % commissions, and no external payment links.

Japan and a few other markets sit somewhere in between, with partial allowances or isolated exceptions, but nothing close to the structural shifts seen in Europe. Most other regions continue to follow Apple’s original setup.

As a result, a single product is forced to maintain multiple parallel monetization stacks. Payment flows, fees, legal terms, and even UX decisions are now made region by region, rather than globally, and this changes how the business operates:

- Analytics — metrics aren’t directly comparable

- Processes — more exceptions, manual decisions, and coordination overhead

- Decision speed — every experiment requires regional context

How the new App Store fees and rules impact subscription apps

LTV becomes harder to predict

For subscription businesses, predictability has always been a strength, but in 2026, two users of the same product can bring in different revenue depending on region or payment flow.

Commissions, App Store fees, and operating costs now differ across regions and setups. As a result:

- subscription LTV is no longer stable or comparable across regions

- financial models need regional context

- forecasting errors grow with scale

Put simply, new Apple EU App Store fees and payment rules add more variables to how revenue plays out over time, making financial planning less certain and forcing more scenario-based thinking, even when the product remains the same.

Margin pressure on paid acquisition

Paid acquisition already ran on thin margins, and in 2026, they’re even thinner. CAC keeps rising, while Apple’s new fee structure adds complexity and delays clarity.

This creates a risky combination: higher user acquisition costs, delayed visibility into real net revenue, and monetization choices that reveal their real effect too late.

For subscription apps, these dynamics can gradually squeeze profitability and weaken the economics of key acquisition channels.

Slower experimentation inside in-app

As payment and compliance setups become more complex, the room to experiment shrinks. In practice, this leads to tighter constraints on pricing tests, less flexibility in combining offers, and longer cycles from idea to production.

Experimentation is still possible, but slower, harder to execute, and more expensive.

Operational overhead becomes permanent

What used to be a one-time setup has turned into an ongoing cost of doing business: legal reviews, compliance and local requirements, monthly payment reporting, and region-specific monetization configurations.

This change creates a lasting drag on speed and execution, which is especially painful for subscription teams that depend on fast iteration and operational efficiency.

Exposure to sudden rule changes

What’s allowed today might be blocked tomorrow. For apps operating across multiple regions, this volatility creates risks that can’t be mitigated by product work alone. It forces structural decisions about where monetization happens, how revenue flows are built, and how quickly the team can adapt when the rules shift.

How leading teams handle Apple’s new monetization rules: 3 strategies

Once the emotional response to Apple’s new fees fades, teams face a single question: how to adapt without hurting the business. The market is settling on a few strategic paths — none perfect, but each solving a different part of the equation.

1. Absorb fees

One way to handle Apple’s new fee structure is to accept it and rebalance your margins elsewhere. This usually means one of two things: raising prices to protect profitability which can hurt conversion rates, or absorbing the costs. To make up for it, teams have to improve retention, increase prices, add upsells, or cut acquisition costs just to keep the same level of revenue.

This is a strategy for survival, not for growth.

2. Localize monetization

You can go further and localize monetization by region: different paywalls, different payment paths, and different pricing and product decisions.

From an economic perspective, this can be effective. Operationally, it adds weight:

- more complexity in code and UX

- internal processes require special rules for different markets

- higher costs of support and mistakes

The approach is viable, but only for teams ready to handle the added complexity at scale.

3. Add web-based monetization

Teams are increasingly turning to the web monetization to take control of how offers are structured, how users pay, and how revenue is captured. This approach provides:

- direct payment methods outside the App Store,

- full control over pricing and paywall logic,

- faster testing and iteration,

- and long-term independence from platform constraints.

| Strategy | Description | Pros | Tradeoffs / Risks |

|---|---|---|---|

| Absorb fees | Keep in-app monetization, accept new Apple fees | Simple setup, stable UX | Lower margins, less flexibility, scaling limits |

| Localize monetization | Adapt pricing and flows by region | Higher relevance, can improve margins | High operational cost, harder to maintain |

| Add web layer | Shift pricing, billing, and experiments to the web | Faster iteration, more control, higher LTV | Requires infrastructure and clear data model |

Monetization strategies in 2026 side by side

What web2app brings to your monetization stack in 2026

1. Additional monetization layer to reduce dependency on a single channel

Instead of relying on in-app flows, you can shift acquisition, onboarding, billing, retention mechanics to the web, where you have more control and fewer constraints.

Case: Glam AI — more control + fewer store fees

A good example is Glam AI, a subscription-based AI app with relatively low ARPU. For products like this, a 30% store fee is a direct margin pressure. The team moved part of their monetization and experimentation to the web with FunnelFox.

The result: higher margins through reduced fees, faster onboarding tests, and more control without engineering work.

2. Faster pricing, offer, and billing experiments

One of the key advantages of web2app is speed. Web funnels make it possible to test pricing, onboarding, and offers without app review constraints, in-app mechanics, or long release cycles.

In the Glam AI example:

- the first web2app flow was launched in a single day

- new creative and onboarding hypotheses were tested in parallel

- new team members reached productivity within 1–2 weeks

In 2026, where fees are complex as never before and rules vary by region, this kind of operational agility becomes a core growth lever.

3. More control over offers and lifecycle moments

Web2app doesn’t stop at payments. It also lets you design key lifecycle moments as product decisions rather than accept them as system constraints.

For example, you can:

- build personalized paywalls with custom logic for regions, cohorts, or entry points

- set up automated payment retries and manage chargebacks with full control

- design custom cancellation flows to reduce churn

4. A hedge against platform and policy risk

Finally, web2app acts as a strategic hedge. When your entire monetization strategy depends on one store, one platform, and one set of shifting rules, you’re building on unstable ground.

Web2app gives you:

- an independent payment and pricing infrastructure you fully control

- a way to adapt faster to regional rule changes without rewriting your app

- long-term resilience by decoupling business logic from platform constraints

Here’s how web2app compares to other monetization setups in 2026:

| Capability / constraint | In-app | External payments | Web2app |

|---|---|---|---|

| Fees | Fixed 15–30% App Store commission | ≈10–20%, fragmented, still partially owned by Apple | 2-5%, depending on the payment provider |

| Speed of experimentation | Low — tied to app review cycles | Medium — needs legal/ops alignment | High — launch in hours, quick iterations |

| Setup complexity | Low | High — requires infra, legal, monthly reporting | Low — pre-built blocks, no code needed |

| Offer & billing flexibility | Limited by SDK & native flow | Depends on custom build | Full — pricing, paywalls, checkout, retries, cancellation logic |

| Control over user journey | Minimal — store-owned UX | Fragmented | Full control — acquisition to churn |

| Risk exposure (policy, fees) | High — fully coupled with App Store | High — subject to audits & rule shifts | Low — independent stack with fallback options |

Where FunnelFox fits in

FunnelFox helps mobile teams take control of their acquisition and monetization and brings together two key components: a web2app funnel builder for fast launches and experimentation, and a modern billing infrastructure for full control over subscriptions, payments, and revenue recovery.

With FunnelFox, you can reduce reliance on App Store flows and get more revenue without adding engineering overhead. Whether it’s launching region-specific offers, adapting pricing without release cycles, or managing churn with alternatives to cancellation, FunnelFox gives you the tools to act quickly and build a more profitable, controllable monetization stack.

In 2026, the winners are not those chasing the lowest percentage, but those who diversify payment flows instead of defaulting to in-app and preserve control points for pricing, billing, and experiments. And FunnelFox is how you get it.

Looking to diversify beyond in-app and protect your revenue? Book a demo.

Final takeaway: Structure beats percentage

The real question in 2026 isn’t how much Apple takes — it’s how your monetization is structured, and what that structure enables. Costs now show up not just in percentages, but also in slower launches, tighter margins, and fewer options to adapt.

That’s why strong teams don’t optimize for the lowest cut. They design for control, flexibility, and speed, and increasingly the web is where they build it.