It’s the payments outside app stores that give web-to-app funnels their biggest edge: lower fees (a quick reminder: we’re talking about 2-5% vs. up to 30% app stores take). But how to set up the payment flow to make the most out of your web-to-app campaign?

Find all you need to know about payments in subscription funnels in this article:

- structure of a high-converting paywall

- payment providers and how to choose one

- perfect checkout anatomy

- real-world benchmarks on how to maximize checkout conversions

Configure the paywall

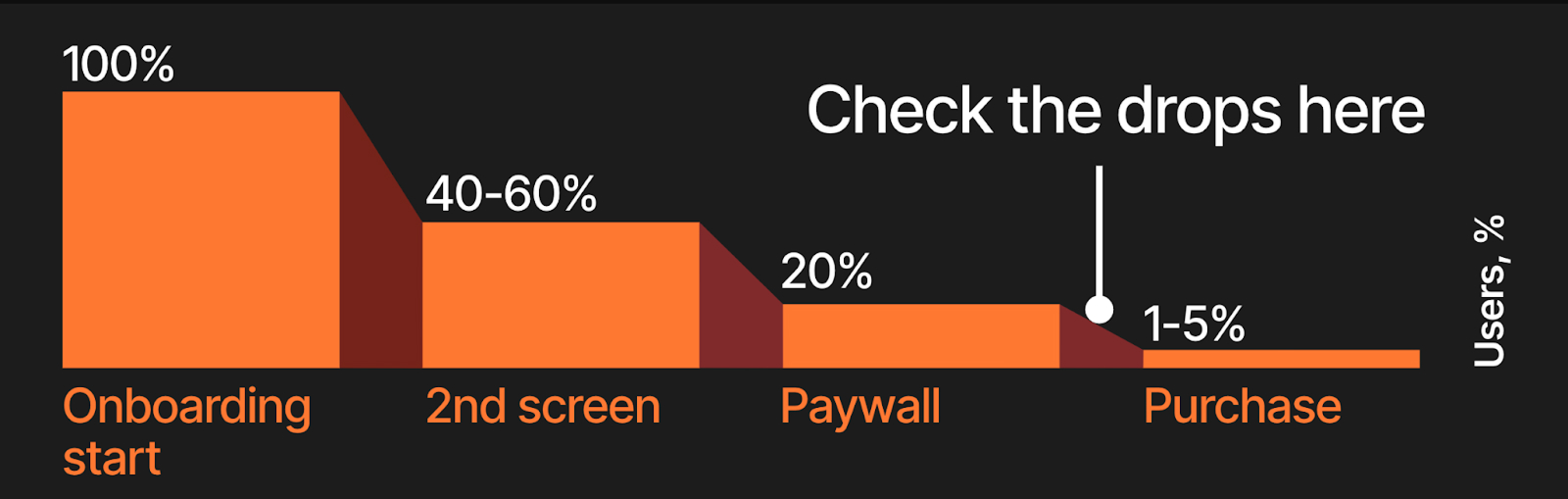

By the time a user lands on your subscription paywall, they’ve already clicked your ad, learned about your app, and invested time and effort into completing your quiz onboarding. The fact that they’ve made it this far means they’re ready—or almost ready—to buy. At this stage, your job is simple: not mess it up. Personalization, proven monetization approaches, and paywall optimization tips will help you get as many users as possible to checkout.

Personalize the offer

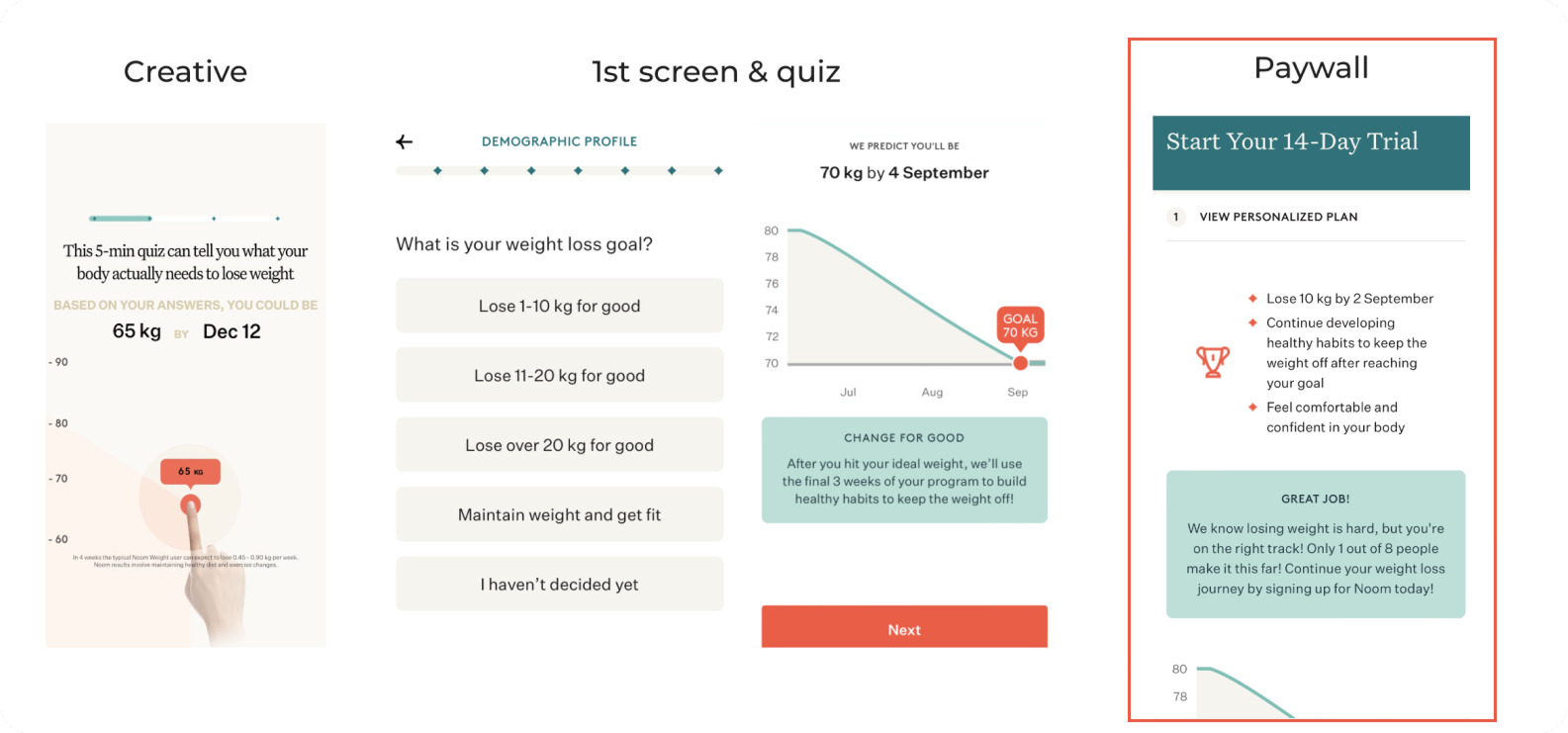

Your paywall should feel like it was made just for the user—the more tailored the experience, the higher the chances to convert. Use the data shared on the onboarding to make the offer feel personal. Show the user exactly what they get and how it matches their goals. It can be a personal plan, progress graphs, or before/after visuals—anything that highlights the value and helps the user commit.

Look how Noom, a weight loss app, uses the answers from the quiz onboarding on their paywall:

↘ Learn how to build a high-converting web onboarding in 6 steps

Shape the offer right

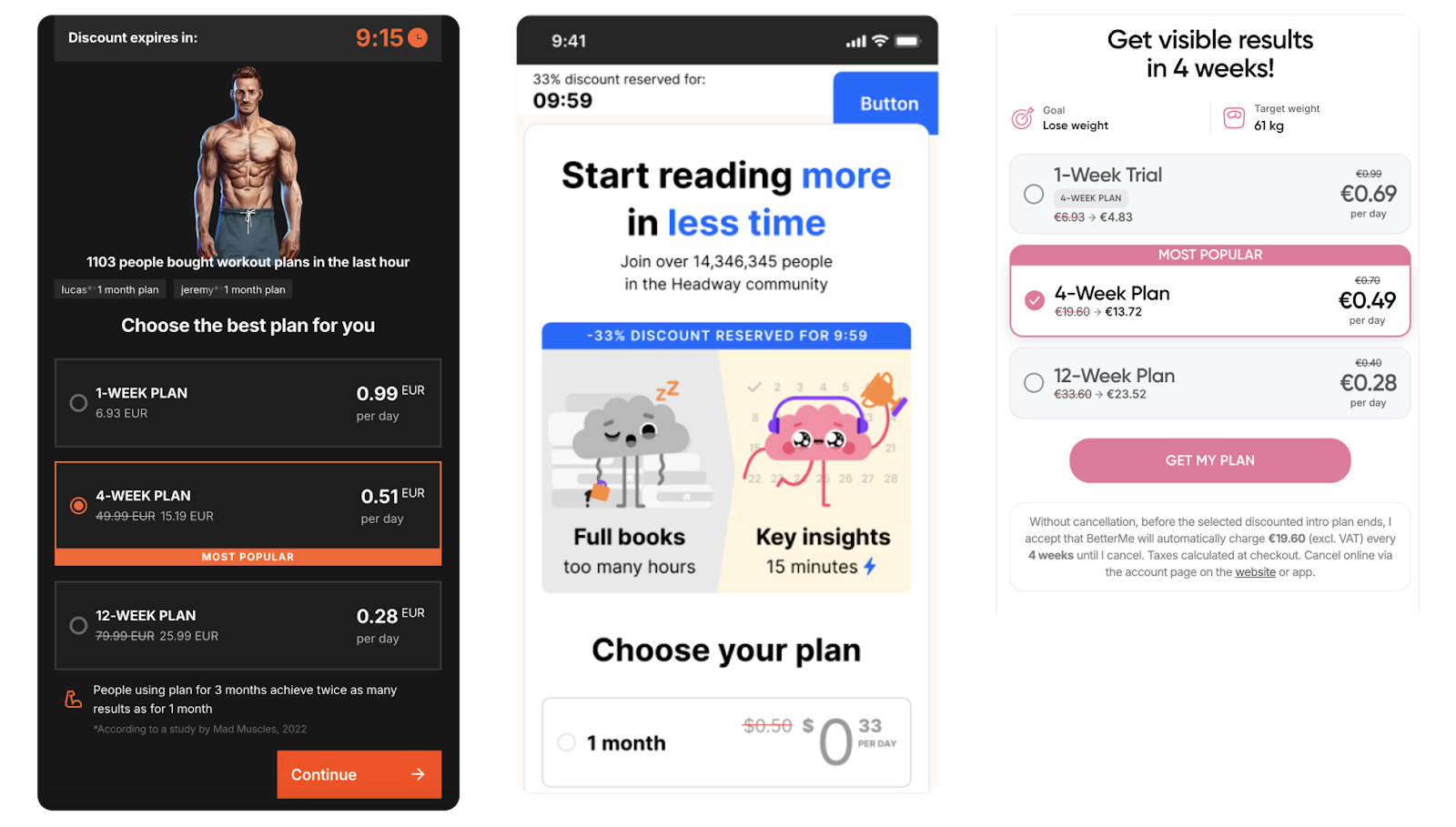

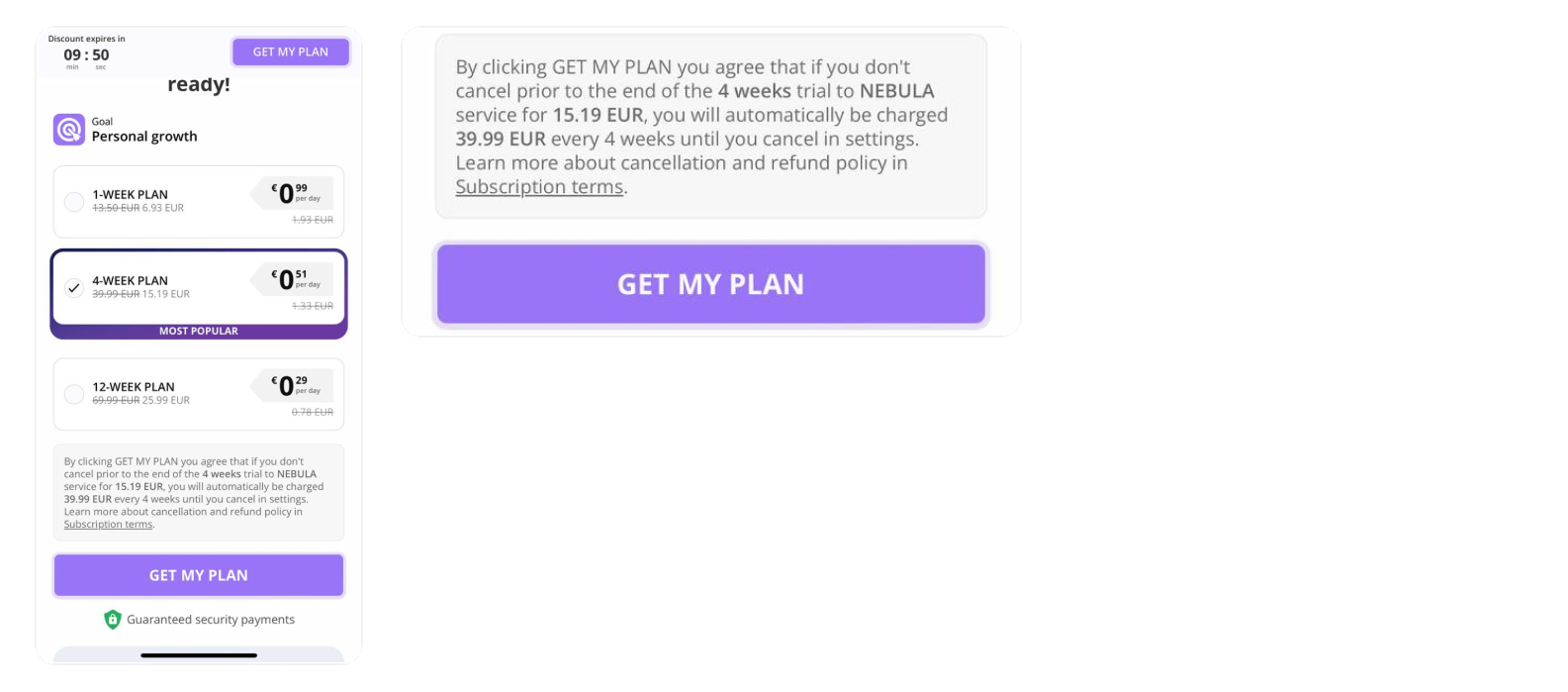

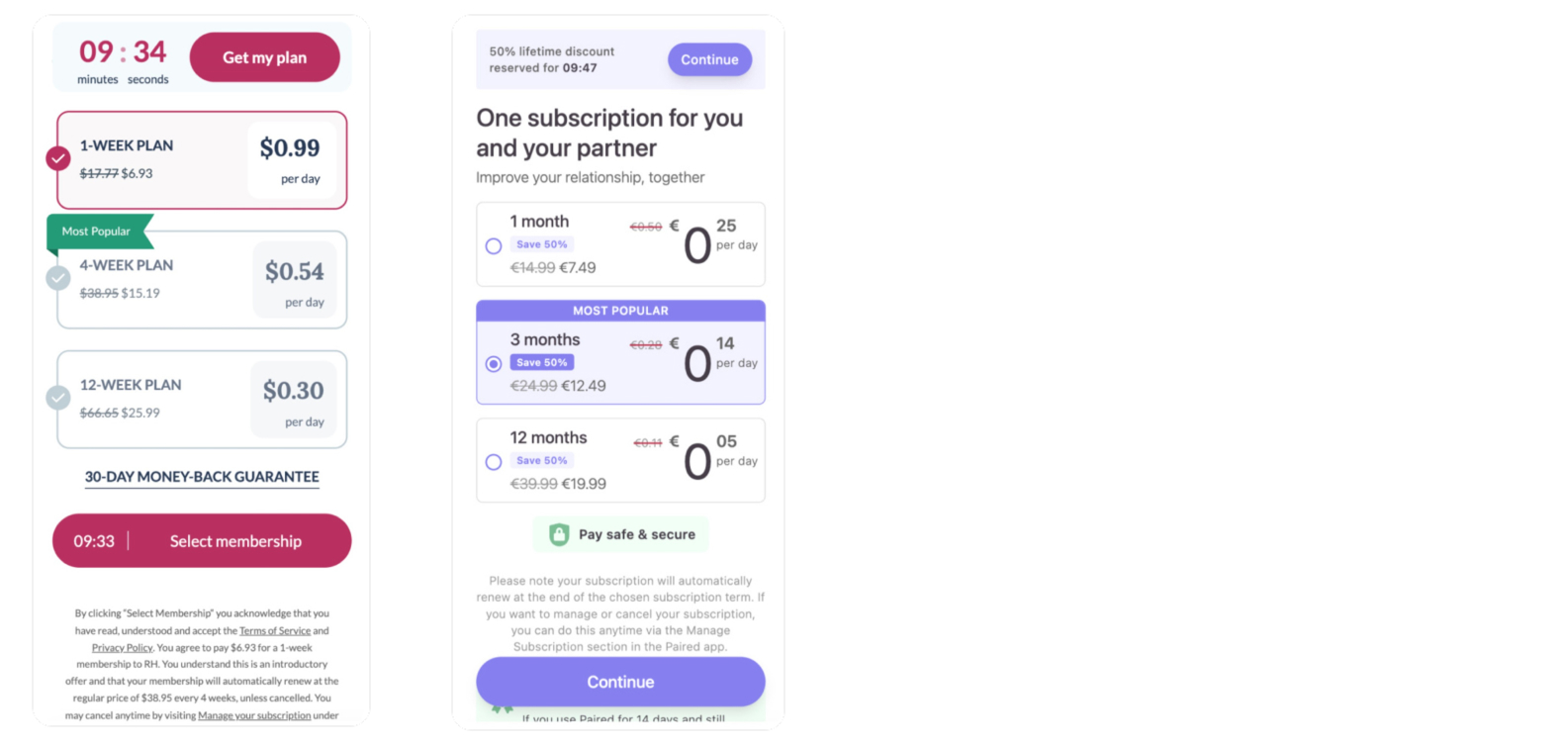

It’s not just what you sell, it’s also how you articulate the offer that affects your paywall CR. The most common and effective subscription paywall configuration uses three tiers:

- 1-4-12 weeks

- 1-3-12 months

💡 Pre-select a pricing plan to reduce decision fatigue and guide users toward a specific plan. Usually, it’s a middle-tier option preselected as it strikes the balance between value and price.

Decide on the pricing strategy

1. Paid trial

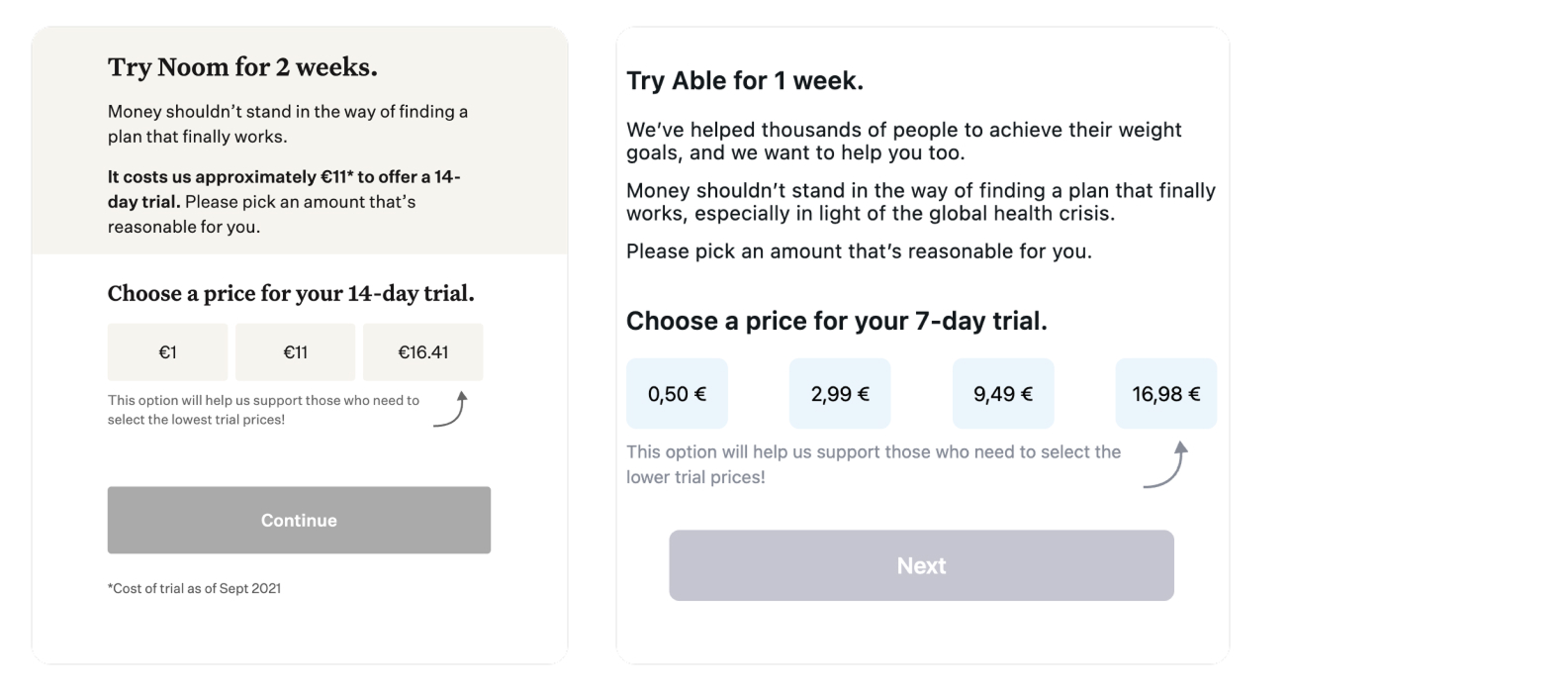

Users pay a small upfront fee for a limited trial period, which later automatically renews at the full price. This approach works best for subscription-based apps and drives better post-trial conversion by filtering low-intent leads and attracting high-quality leads who are willing to and can pay.

Though a paid trial may reduce the number of initial sign-ups due to the upfront cost, it outperforms a free trial in the long run.

💡 Show users what it costs you to offer them a trial with a discount. This helps to anchor the value, explains costs to users, and provides an affordable option to those who need it.

2. Introductory price

The introductory price for the first billing period can attract users who might hesitate to pay the full price. Instead of walking away without paying anything, they subscribe at a lower rate, explore the app, feel its value, and are more likely to renew at the full price when the discount ends.

💡 Consider framing the introductory price not as a temporary discount but as a special offer for new users. You can also present it as a time-limited deal to create urgency.

3. Free trial

While still a popular approach, it’s at the end of the list for a reason. Free trials are indeed an easy entry point that encourages users to explore your app. But they also lead to a lower commitment and reduce post-trial conversion rate.

↘ Learn why many apps avoid offering free trials in our article on web-to-app trends.

Enhance your subscription paywall even further

Here are a few tips to boost your paywall conversion rate:

- Adding customer reviews and social proof helps to build trust and drive conversions

- A clear, prominent money-back guarantee reduces perceived risk and increases user confidence

- Security and contact information ensure users feel safe and know they can contact you to address any payment or data protection concerns

- FOMO and urgency elements such as countdown timers or limited-time offers encourage users to act quickly

Avoid these 4 mistakes that kill your paywall

- No value in the offer and no match with onboarding storytelling

- Poor value visualization

- Low warming up: no personalization, timers, social proof, etc.

- Weak CTA: Pay/subscribe button, poorly highlighted button, etc.

Choose a payment provider: PSP vs MoR

For some, the thought of handling payments and bills after the App Store has been doing transaction processing, local banking networks, and global taxes, is the main roadblock. And yes, when you move to the web, you’re in charge of all that.

But here’s the thing: it’s not as complicated or time-consuming as it seems. The key is to choose the right payment provider.

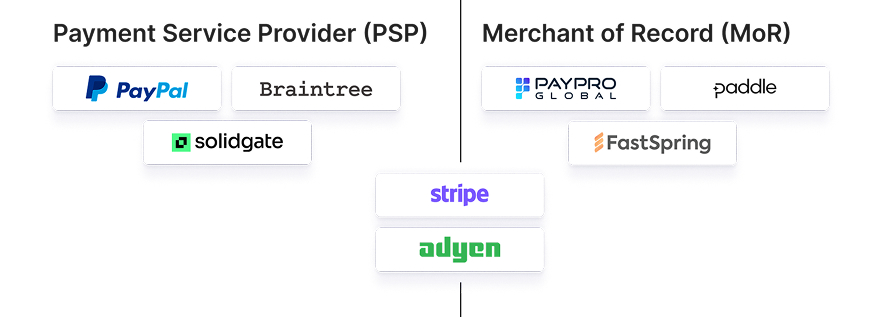

There are 2 types of payment providers: PSP (Payment Service Providers) and MoR (Merchant of Record). Let’s explore which do what and how to pick the right one for you.

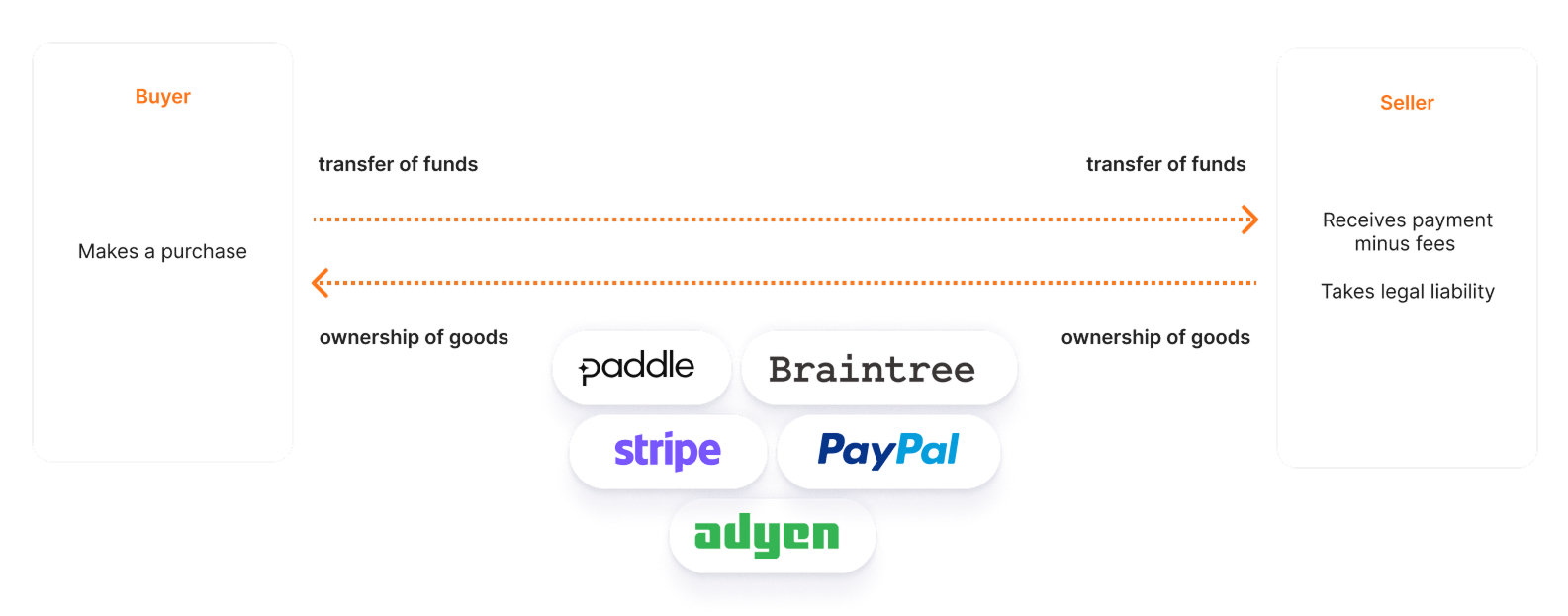

Payment Service Providers (PSP)

PSPs give you the tools to handle transactions yourself so you act as the direct seller, using your merchant account to process payments. (Merchant is a digital ID used by banks to identify the seller and process payments.)

Flow:

- The buyer makes a purchase

- Transfer of funds and ownership of goods

- You, the seller, receive payment minus fees and take on legal liability

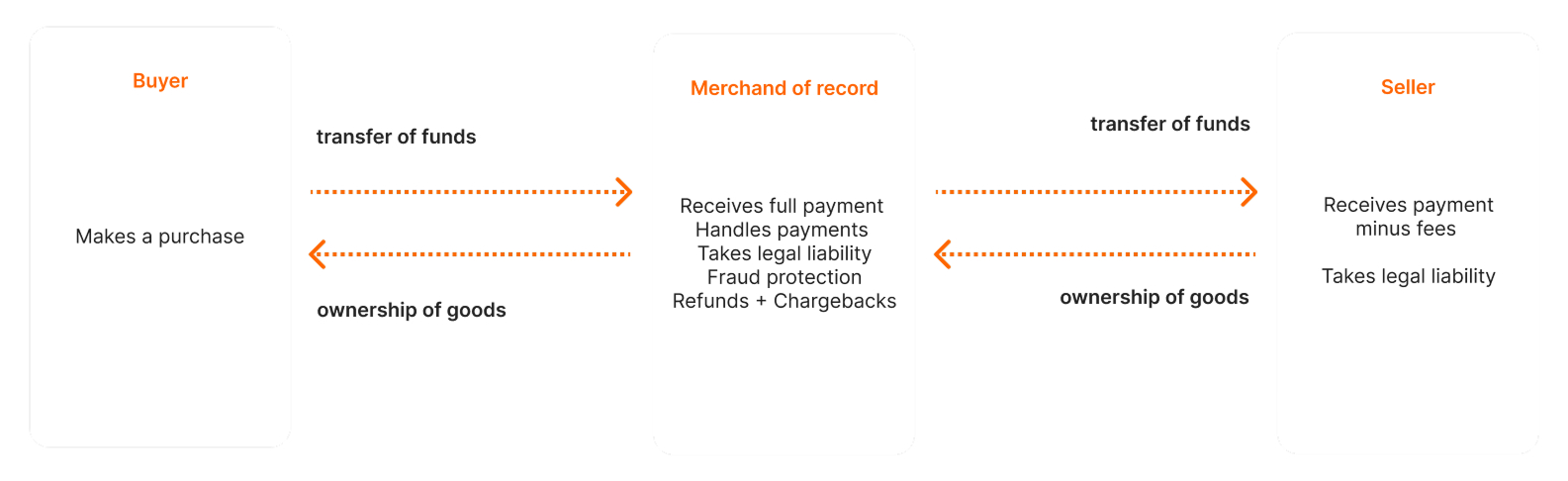

Merchant of Record (MoR)

With MoR, you outsource the entire transaction process, taxes, compliance, and refunds. From the user’s perspective, the Merchant of Record is considered the seller.

Flow:

- The user makes a purchase

- The MoR receives full payment, handles legal issues, manages fraud protection, and processes refunds or chargebacks

- You receive payment minus taxes and fees

PSP vs MoR: comparative table

| PSP | MoR | |

| Control | Full control over payments, invoices, and user notifications. | Minimal control; MoR manages the entire process. |

| Customization | Highly customizable checkout flows. | Limited customization, which can impact conversion rates. |

| Legal & tax responsibility | You handle all taxes, regional compliance, and fraud disputes. | MoR manages taxes, compliance, and fraud for you. |

| Ease of setup | Requires more effort to set up and maintain. | Easy to implement; designed to handle everything out of the box. |

| Fees | Lower fees, but with added responsibilities. | Slightly higher fees, but fewer operational headaches. |

So, which payment provider is right for you?

The choice ultimately depends on your goals and resources.

PSPs are great if you prioritize flexibility and have someone on the team to handle the backend work. Stripe is a smart move here for more control, but remember: taxes, compliance, and chargebacks—that’s all on you.

Choose PSP if:

- You want full control over the payment experience and checkout customization

- You’re ready to handle regional compliance, taxes, and fraud protection

- You have the resources to set up and maintain your payment infrastructure

MoRs, on the other hand, are your provider of choice if you want to focus on product growth without worrying about payment infrastructure. If you’re going with a MoR, we recommend Paddle. It handles taxes, VAT, and compliance, so you don’t have to deal with legal complexities.

Choose MoR if:

- You prefer a plug-and-play solution that handles the complexities of payments for you

- You want to avoid managing taxes, compliance, and disputes

- You’re okay with slightly less control over the checkout process

💡 Pro tip: the best combination is Stripe for card payments and Paddle for PayPal.

Web checkout done right

Web checkout is where the money is finally made. Or lost—even small friction can cause significant checkout drop-offs. Here’s how you configure a web checkout flow that drives conversions.

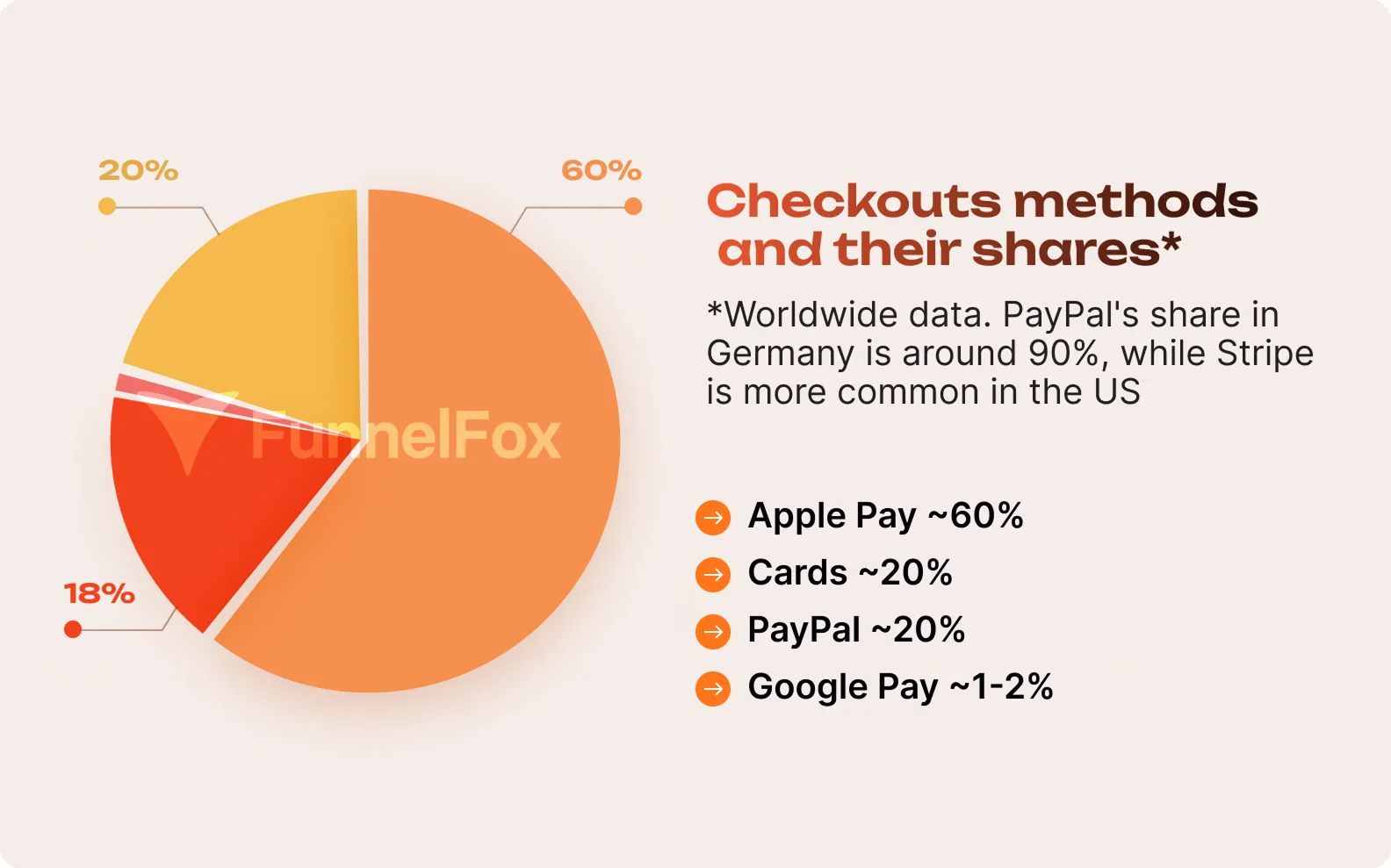

First, make sure to offer convenient payment methods. Here’s how they break down by popularity:

💡 In certain geographies, there are specifics—PayPal’s share in Germany can reach 90%. In the US, payments through Stripe are popular—saving card details and enabling one-click payment. Consider that when selecting payment options to display on your web checkout.

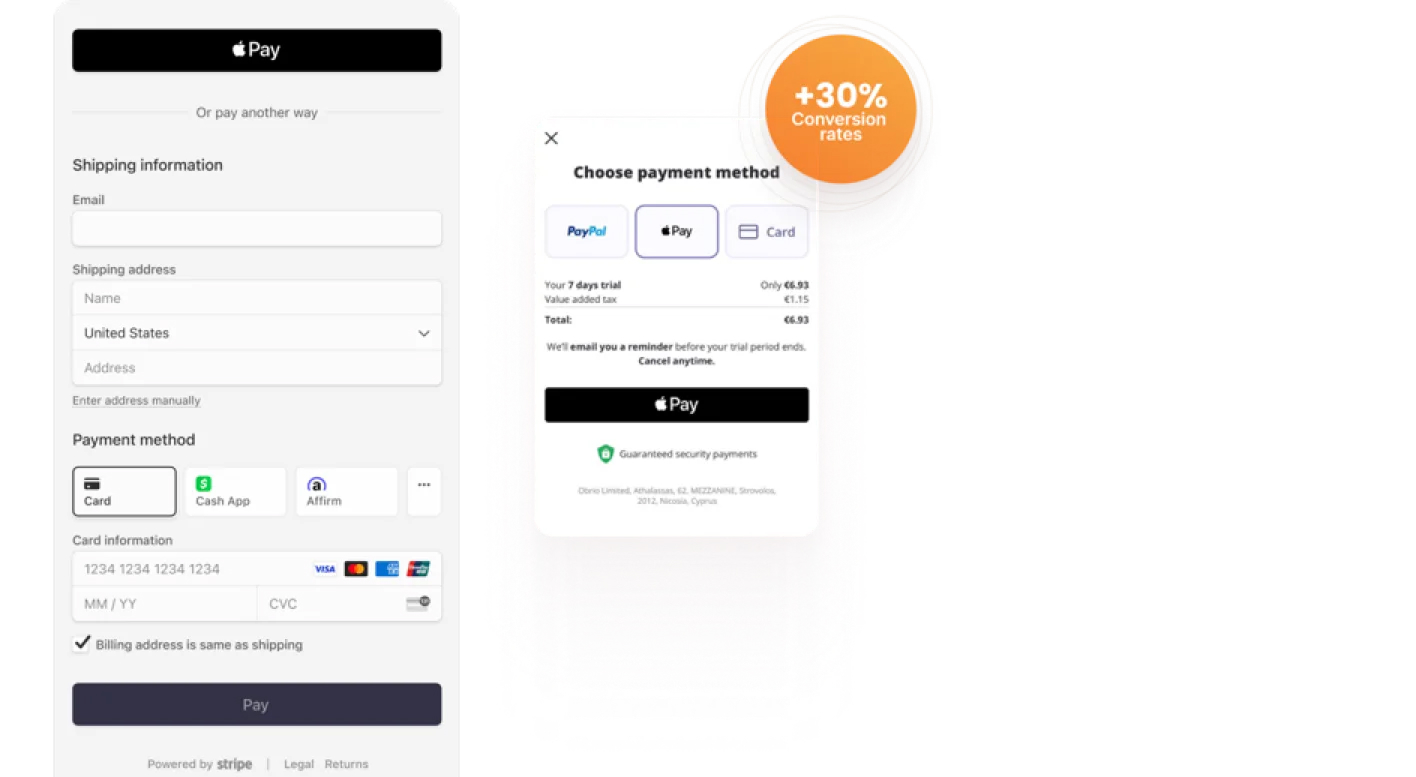

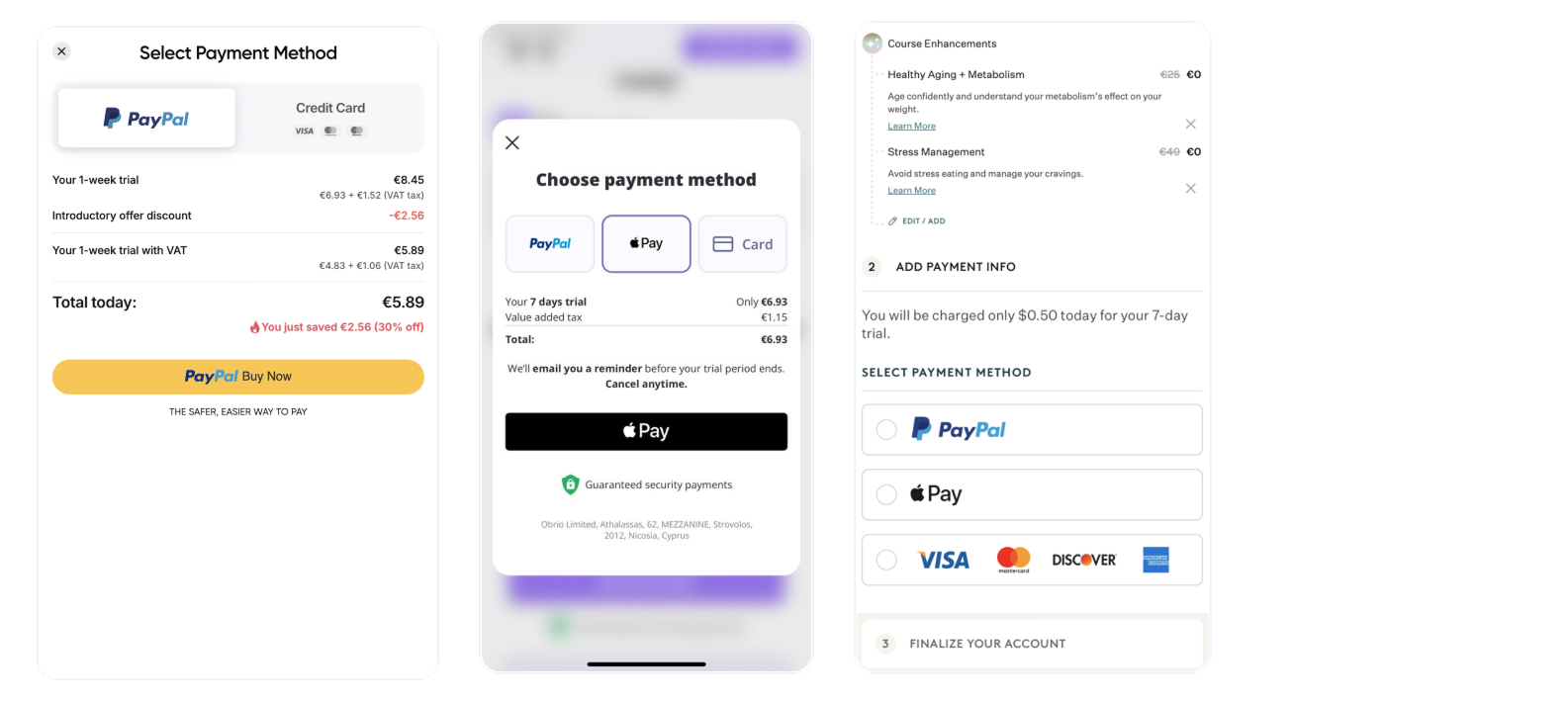

Default checkout vs. custom checkout

Checkouts directly affect conversion. You can either opt for a default or a custom checkout.

- Default checkouts are not optimized for your product—they often come with a cluttered layout of fields (perceived as excessive by users) and too much friction. Default checkouts perform 20-30% lower than custom ones.

- Custom checkouts, in contrast, are designed to reduce friction and feature a single button and a clear and straightforward checkout process

Compare default and custom checkout:

We’d recommend a custom option—it isn’t just a UX win, but an important element of your subscription funnel that directly influences the conversion and, ultimately, revenue.

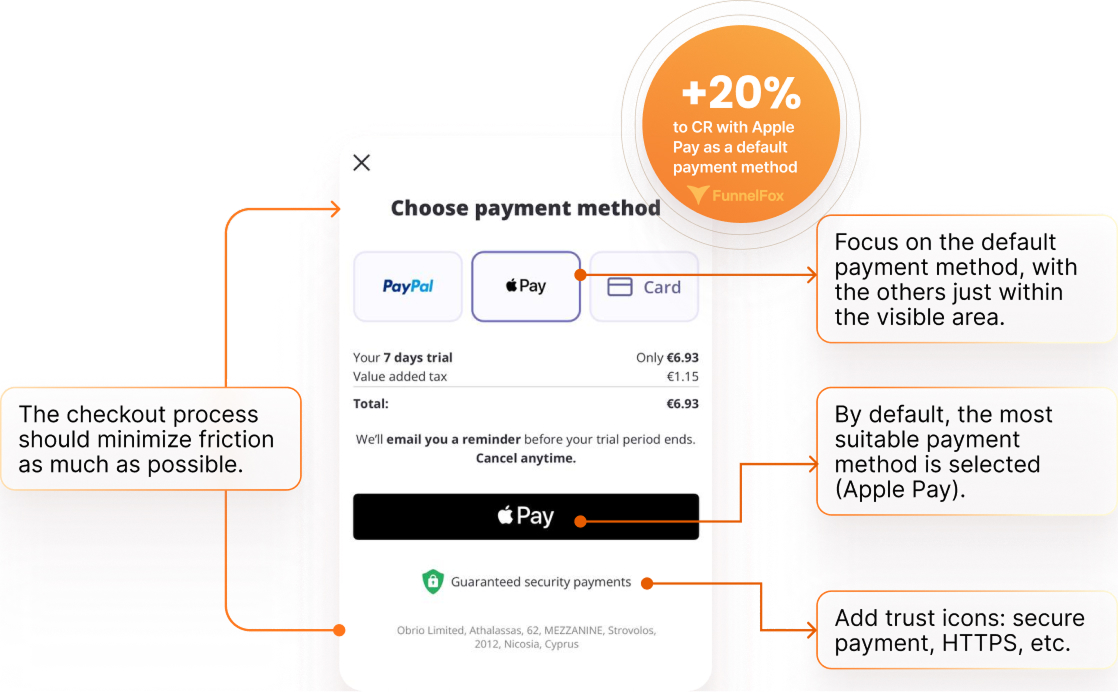

Here’s how you create the perfect web checkout:

- Keep it simple. Minimize the number of fields and steps required to complete the payment

- Select the most suitable payment option for the user (e.g., Apple Pay for iOS users). Show other payment methods like cards or PayPal within easy reach but not as the primary choice.

- Build trust with visual cues like “Secure Checkout,” lock icons, or PCI compliance seals.

Where to place your checkout

Your checkout should feel like a natural extension of the user journey, not an afterthought. Consider these placement options:

- Separate screen: ideal for keeping the payment step clean and focused

- Modal window: overlays the paywall to reduce disruption in the flow

- Directly on the paywall: keeps the experience seamless, especially for users who are already warmed up

💡 Avoid redirecting users to external pages for registration or payments. Redirects break the flow and can cause a major checkout drop-off. A consistent, end-to-end funnel—ad → quiz → paywall → payment—keeps users engaged and increases checkout conversion rates.

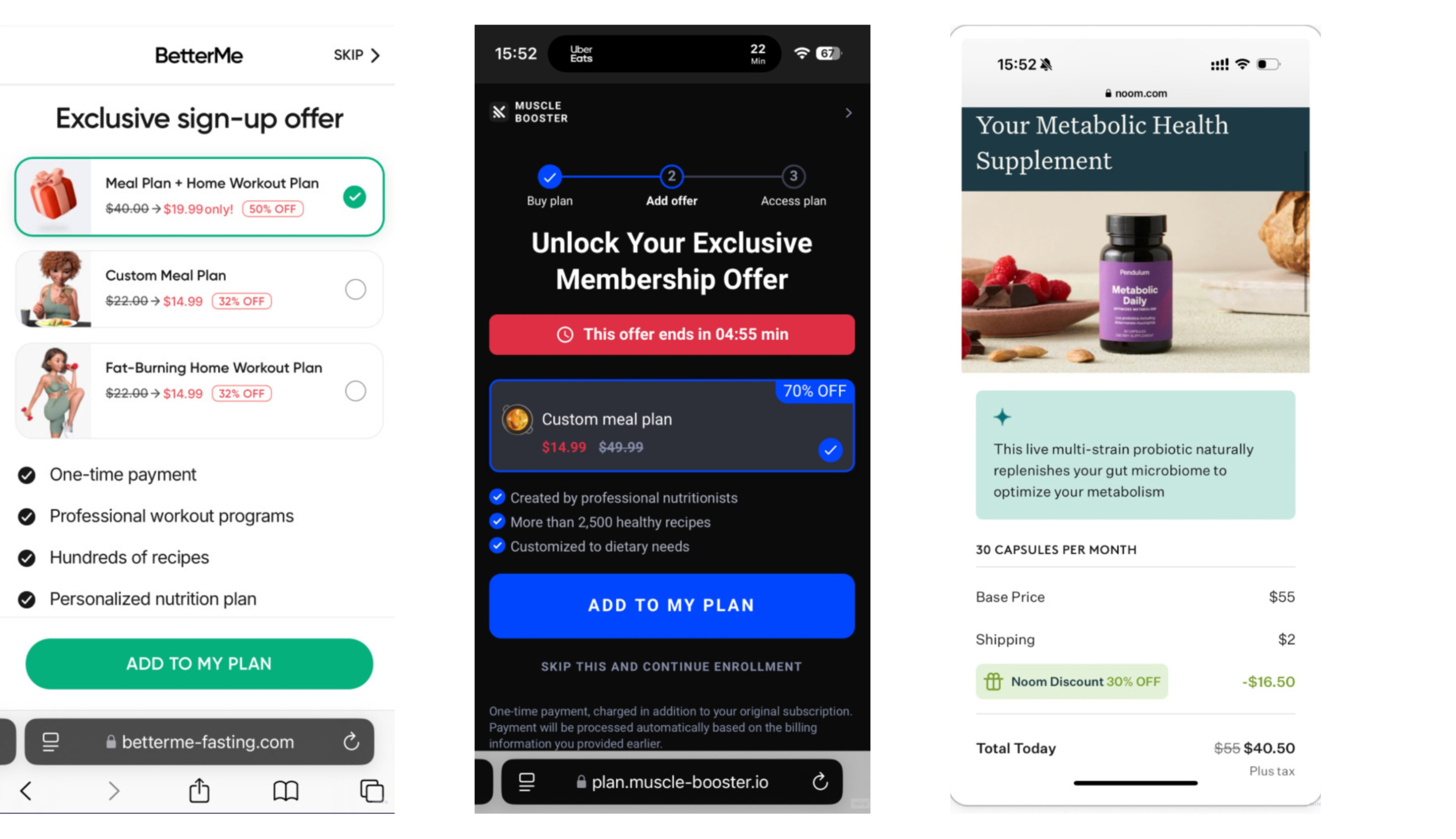

Boost LTV with upsells & cross-sells

Monetization opportunities in web-to-app don’t end with the subscription purchase. There are also upsells and cross-sells that can help increase your LTV. When done right, they’re perceived as a logical follow-up of the user’s purchase rather than an aggressive sales tactic.

Upsells work best when they’re relevant to the user’s purchase and positioned at the right moment (usually right after checkout). A fitness app selling a personalized workout plan might cross-sell a tailored meal plan or nutrition supplements. A language-learning app could offer an exclusive grammar guide or one-on-one coaching sessions as an upgrade.

You’re not limited to only one upsell offer—Noom, for example, features six upsells in a row, and Headway goes with three. Experiment to find the number and combination of upsells that’ll work best for you, but don’t push too aggressively. Upselling and cross-selling aren’t about just squeezing more money out of users, but about delivering even more value.

↘ Learn other strategies to maximize the potential of web-to-app funnels for your app

Manage disputes and refunds to protect revenue

When handling payments outside of native app stores, it’s up to you to deal with refunds, chargebacks, and dispute prevention. Here’s what matters most.

Refunds: a retention opportunity

Refunds happen when users reach out directly and ask for their money back. Unlike chargebacks, they don’t hurt your reputation with payment providers, and you have full control over the outcome.

💡 Refunds don’t have to be all-or-nothing. A 50% refund, for example, can help you retain users who would otherwise churn. You lose less revenue — and possibly keep the customer.

Disputes (chargebacks): avoid them at all costs

A chargeback occurs when a user disputes a charge with their bank instead of contacting you. Even if you win the case, it still counts against your dispute rate — and that’s what payment networks care about.

High dispute rates = higher fees, penalties, or even a permanent ban from PSPs.

Visa Dispute Monitoring Program

| Dispute count | Dispute rate | Fines | |

| Early warning | 75 | 0.65% | None |

| Standard | 100 | 0.9% | Fines begin after four months and continue monthly until removal. |

| Excessive | 1000 | 1.8% | Fines begin immediately and continue until removal from the program. |

Mastercard Monitoring Programs

| Dispute count | Dispute rate | Fines | |

| Excessive Chargeback Merchant | 100–299 | 1.5% – 2.99% | Fines begin in month two and continue at increasing rates. |

| High Excessive Chargeback Merchant | 300+ | 3% | Fines begin in month two and continue at increasing rates. |

⚠️ Even if your rate is below Visa/Mastercard limits, some PSPs may still block you.

3 ways to stay safe and keep your dispute rate low

1. Use dispute alerts to prevent chargebacks

Tools like Merchanto can alert you before a chargeback is formally filed. You get a chance to issue a refund, avoiding the dispute altogether.

This is the only way to:

- Reduce processing fees and block risk

- Stay below critical thresholds

- Avoid being flagged by Visa/Mastercard

2. Fix your payment setup

- Use recognizable descriptors in your payment statements

- Display refund contact info post-checkout

- Make your refund policy easy to find

- Clearly explain subscription terms and recurring charges

3. Don’t treat all disputes the same

If someone claims the charge was “unauthorized,” and you never explained recurring billing clearly, it’s your fault. A bit of upfront clarity saves you from costly disputes later.

This is just one part of building a resilient payment strategy. For more insights on fallback logic, checkout setup, payment orchestration, pricing models, and chargebacks prevention, check out our Guide to Web2App Payments.

Wrap up on web-to-app payments

Here’s a quick recap of the most important points:

- For your paywall to sell, it needs to feel personal, feature the right pricing strategy, and clearly communicate the offer’s value.

- The choice between payment providers is about finding the balance between responsibility and flexibility. If you want full flexibility and don’t mind some responsibility, go with a PSP. If you’d rather avoid dealing with taxes, disputes, and compliance, MoR is your best bet. The best choice is Stripe + Paddle.

- A seamless checkout web flow with the right payment options, minimal steps, and trust signals is essential.

- Set up Apple Pay as a default payment method since it gives up to +20% to CRs.

- Monetization doesn’t end with the subscription purchase—when done right, upsells & cross-sells can grow your ROAS and LTV without feeling pushy.

Web-to-app payments made simple with FunnelFox

Struggling with clunky payment flows, lost revenue, or juggling multiple payment providers? FunnelFox Billing brings everything together in one platform, so you can launch high-converting paywalls, streamline web checkouts, and automate revenue recovery with no code.

Everything you need in one place:

- Frictionless integration with any PSP or local payment method

- Unified dashboard for subscriptions, refunds, and chargebacks across all providers

- Smart payment routing, automated retries, and payment cascading without custom code

- Provider-level and network tokenization for uninterrupted billing, even if a provider blocks your account

- Automated card updates and seamless provider switching

- Built-in PayPal and network chargeback prevention

See how FunnelFox Billing can transform your web payments and make scaling your subscription revenue effortless.